8 Essential Tips to Keep Your Holiday Spending in Check

Updated November 7, 2019

While we may not be able to control how much you drink this holiday season, we may be able to help you avoid a holiday (financial) hangover. Ditch the stress and regret and roll into 2020 your best self with our essential tips for keeping your holiday spending in check.

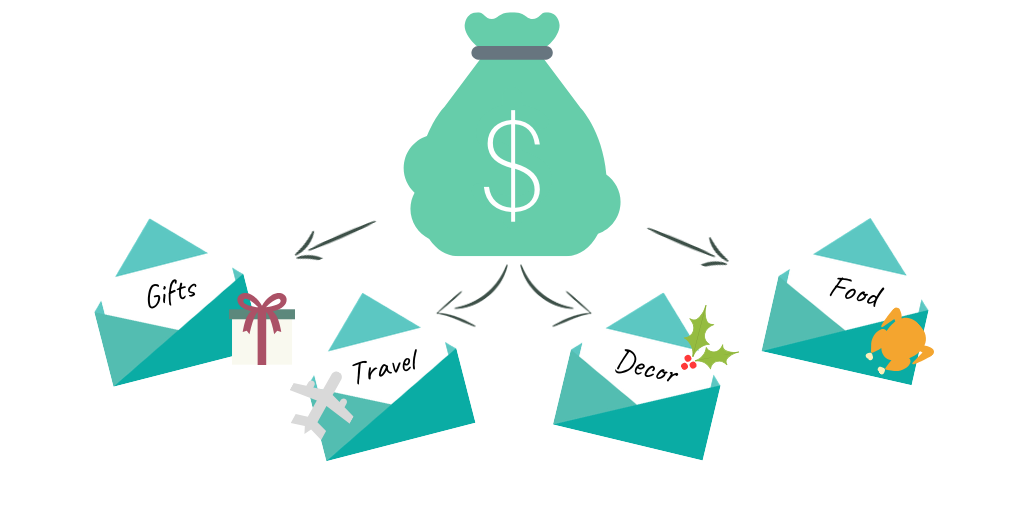

1. Set a budget - Setting a budget should always be your starting point. Make a list of everyone you wish to purchase gifts for. Don’t forget about including other holiday expenses such as additional food and beverage costs if you’re hosting, decorations, travel and accommodations, donations etc. to keep it as realistic as possible. You might also consider adding a “holiday spending” line to your regular monthly budget to set aside funds each paycheque specifically for this time of year.

2. Envelope method - Create an envelope for each category (gifts, food, decorations etc.) or for each person you buy for and put their name on it. Allocate cash to each of the envelopes and use that for the purchases. Think you still might be tempted to over spend? Only bring the envelope into the store with you and leave the credit cards at home.

3. Put away the plastic - This stems off our last point. Unless you are using your credit cards strategically to earn rewards, don’t put your holiday purchases on them. Many Canadians and Americans are still paying off balances from their 2017 holiday spending - ouch! Unless you have the means to pay off the balance right away, don’t make the purchase. Wait until you can afford it or forgo.

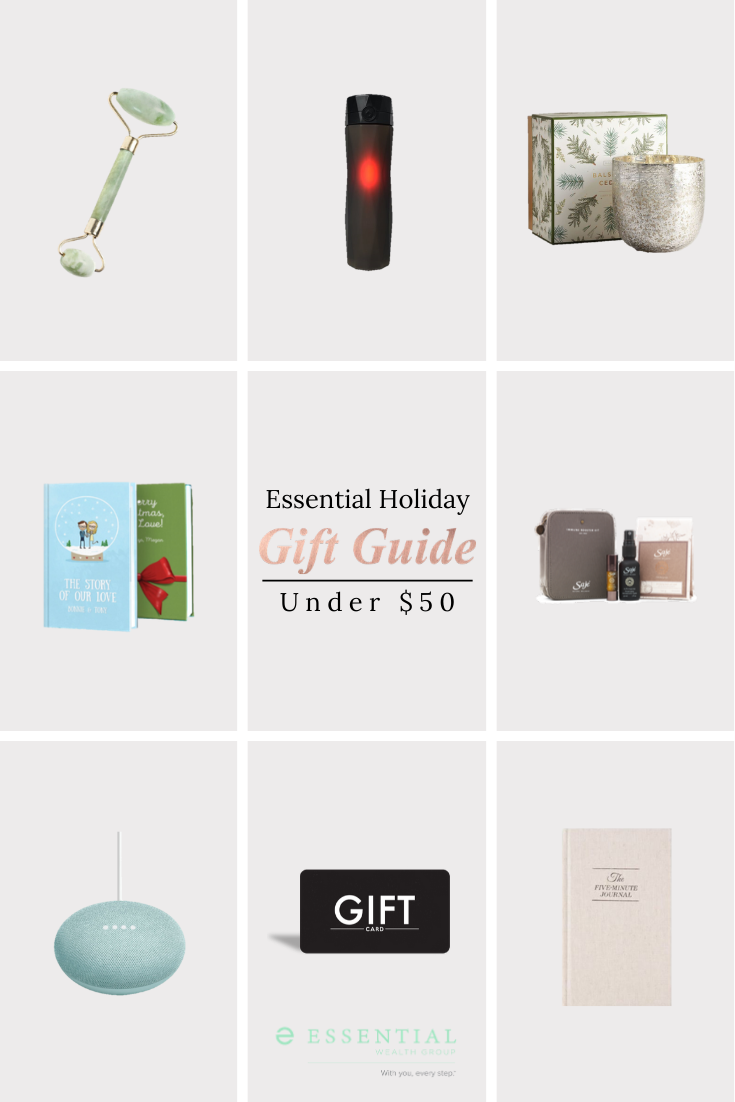

4. Gift exchange -  If you have a large group of friends or family and feel overwhelmed with the pressure of buying multiple gifts, suggest doing a gift exchange like Secret Santa or White Elephant. You can set a dollar limit everyone is comfortable with, it makes for a fun activity and everyone walks away with a gift. Be sure to check out our Essential Holiday Gift Guide for our team's picks under or around $50.

If you have a large group of friends or family and feel overwhelmed with the pressure of buying multiple gifts, suggest doing a gift exchange like Secret Santa or White Elephant. You can set a dollar limit everyone is comfortable with, it makes for a fun activity and everyone walks away with a gift. Be sure to check out our Essential Holiday Gift Guide for our team's picks under or around $50.

5. Redeem rewards - Did you know that 31% of credit card holders aren’t redeeming their points! Take advantage of your rewards and/or cash back features to help offset your holiday expenses.

6. Start early - alright we'll admit that we have a hard time taking our own advice on this one (maybe some of us excel under pressure ok…) but consider shopping for the holidays throughout the year. Watch for sales and pick up items here and there to spread out the spending. Maybe you’ll even be done before they start playing Christmas music in the malls. Then it really would be ♪ the most wonderful time of the year! ♫

7. Speaking of malls...skip 'em - Besides avoiding the stressful situation of trying to find a parking spot (which we think is reason enough), online shopping has a lot of benefits that can save you some big bucks like price matching, coupon codes and the ability to sign up for rewards programs. Also, if you like to online shop and haven't signed up for Rakuten (formerly Ebates) what are you waiting for! You can thank us later.

8. Be realistic - Our last and most important point. It’s so easy to get caught up in the materialistic world that the holiday season has become (especially with social media). If you’re feeling overwhelmed, take a step back and remember what’s really important; spending time with loved ones, making memories, being kind, giving back etc. Try not to compare yourself to others, Christmas should not be a competition.

Posted In: Newsletters