Monthly Market Snapshot – February

After one of the most challenging calendar year performances since 2008, U.S. equities posted strong gains in January. The gains came as investor sentiment around the notion that the Fed could pull off a soft-landing scenario as opposed to a much-feared deep recession became more prominent. Corporate earnings are in full swing with investors eagerly awaiting to see how corporates fared against rising cost pressures. Overseas, the International Monetary Fund inched up its outlook for global growth this year, reflecting greater-than-expected resilience in economies across the world.

Canada’s benchmark S&P/TSX Composite Index was 7.1% higher in January, as all the benchmark’s underlying sectors were positive during the month. The gain was led by the information technology and health care sectors, with 19.5% and 14.4% returns, respectively. Small-cap stocks, as measured by the S&P/TSX SmallCap Index, gained 8.8% for the month.

The U.S. dollar depreciated by 1.8% versus the loonie during the month, slightly dampening the returns of foreign markets from a Canadian investor’s standpoint. Note that all returns in this paragraph are in CAD terms. U.S.-based stocks, as measured by the S&P 500 Index, rose 4.5% in January. The benchmark’s top-performing sectors for the month were consumer discretionary and communication services, with respective gains of 13.2% and 12.5%. Utilities, health care, and consumer staples were the only sectors in the red during the month, falling 3.5%, 3.5% and 2.6%, respectively. International stocks, as measured by the FTSE Developed ex US Index, advanced 6.5% during the month, while emerging markets rose 5.6%.

The investment grade fixed income indices we follow were up in January. Canadian investment grade bonds, as measured by the FTSE Canada Universe Bond Index, increased by 3.1% during the month, while the key global investment grade bond benchmark rose 3.3%. Global high-yield issues added 4.0%.

Turning to commodities, the price of natural gas plummeted 40% during the month, while crude oil was off 1.7%. Copper and gold had a positive month, with respective gains of 10.9% and 5.7%, respectively. Silver fell 0.8% in the same period.

Inflation in Canada edged down to 6.3% year-over-year in December, largely due to slower growth in gasoline prices. The Canadian economy added 104,000 jobs in December, as the nation’s unemployment rate dropped to 5.0%. The Bank of Canada raised its benchmark interest rate by 25 basis points and signaled that this could be the peak for the current tightening cycle.

U.S. nonfarm payrolls increased by 223,000 in December, as the unemployment rate improved to 3.5%. The consumer price index increased 6.5% year-over-year in December. The slowing inflation rate was due in large part to a 9% decline in gasoline prices from a month ago. U.S. retail sales in December dropped by 1.1%. In the first FOMC meeting of 2023, the Federal Reserve is expected to raise its benchmark rate by a quarter percentage point to a range of 4.50% to 4.75%.

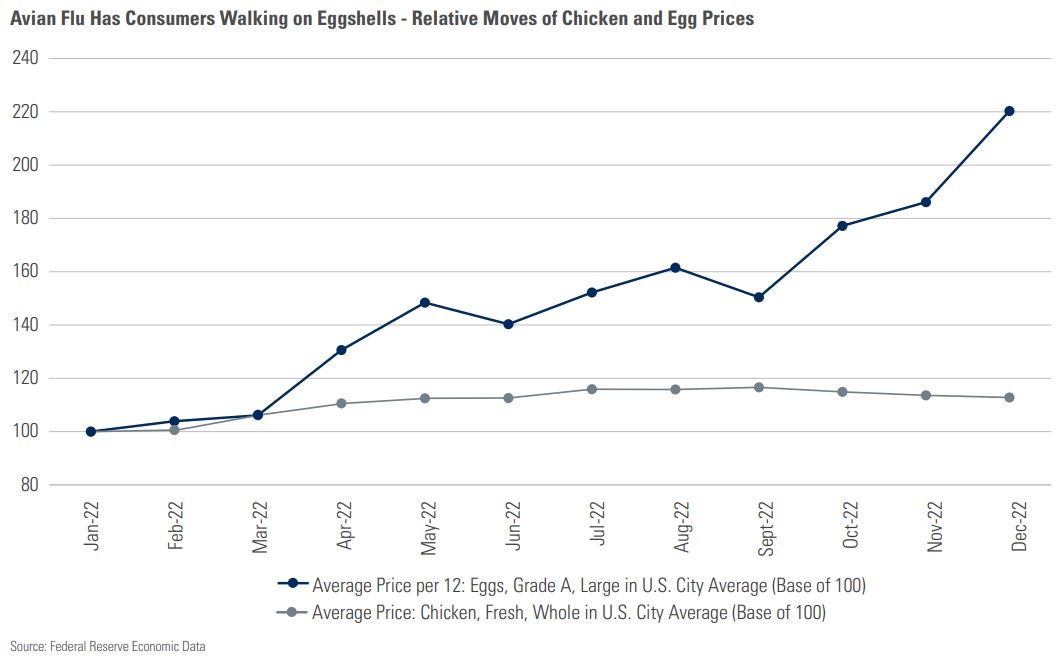

Chart of the Month

Egg prices are absolutely soaring, while chicken meat prices have been well-grounded. The graph above shows that the average price of whole fresh chickens rose 13% between January and December 2022, while the average price of a dozen eggs was up 120% over the same period. A big driver of the price spike was that repeated outbreaks of avian influenza ravaged farm flocks of egg-laying hens in 2022, drastically reducing the supply of eggs. But why hasn’t the price of chicken meat experienced anywhere near the same degree of inflation? Well, farmers don’t have all their chickens in one basket. Chickens raised for meat (a.k.a. “broilers”) have been less exposed and therefore less susceptible to the avian influenza that has decimated the egg-laying hens, and the supply of broilers has been reduced less than 1/10 of 1%. Because these two separate supplies of chickens have not been equally affected, neither have their prices. And because eggs are hard to substitute, relatively small declines in supply have a large impact on prices, resulting in the latest surge. This “eggflation” crisis has gotten so bad that Customs and Border Protection reported a 108% increase in egg seizures as smugglers tried to get supplies across the U.S.-Mexico border.

Posted In: Market Updates