What is a realistic rate of return?

"What rate of return can I expect?" That’s a question we get often from our clients and especially now that our near decade-long uphill run may be coming to a plateau. Many younger investors are not familiar with bear market conditions and have never experienced significant amounts of volatility or a recession. Even the ones who have been around often forget what it’s like to see a negative on a month-end statement.

"What rate of return can I expect?" That’s a question we get often from our clients and especially now that our near decade-long uphill run may be coming to a plateau. Many younger investors are not familiar with bear market conditions and have never experienced significant amounts of volatility or a recession. Even the ones who have been around often forget what it’s like to see a negative on a month-end statement.

The relationship between risk and return.

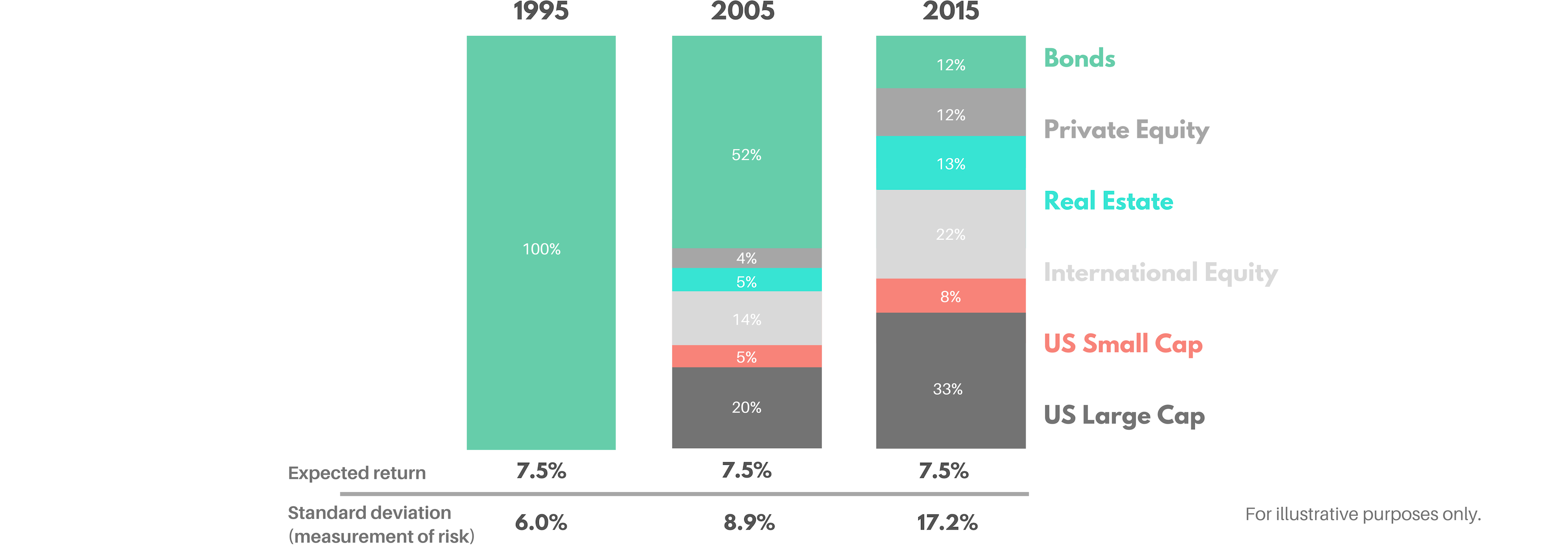

Let’s start by acknowledging that the world of satisfactory returns from “risk-free” investments is no more. Remember the days where you could get high single or even double-digit returns from a GIC? Yeah…long gone. The relationship between risk and return has drastically changed over the last couple decades. Looking at 1995 for example, to achieve the same 7.5% return today, an investor would have to take on almost three times as much risk in their portfolio.

Source: Wall Street Journal

Your neighbour’s financial grass is seemingly always greener.

We think it’s important to set realistic return expectations that are not only in line with today’s market environment but more importantly, your goals and objectives. Comparing your personal portfolio returns to broad market indices or someone’s boast about their jackpot investment win is a fool's errand.

Market indices do not take into account the impact of taxes, trading costs and fees, and cash flows in and out of the portfolio. The TSX Composite Index and the S&P 500 Index mirror a basket composed entirely of stocks invested 365 days per year with no cash or fixed-income component. Your neighbour may have scored big that one time, but at what risk? Take everything you hear with a grain of salt and if there’s one thing we’ve learned, if it sounds too good to be true, it probably is.

So what can you expect?

John Bogle, founder of Vanguard Group, the world’s largest provider of mutual funds said in an interview with The Global and Mail "stock market returns will be considerably less than they have been over the 65 years I have been in the business. They averaged about 11%, but I think stock market returns in the future would be fine if they did 4% or 6% a year each year over the next 10 years."

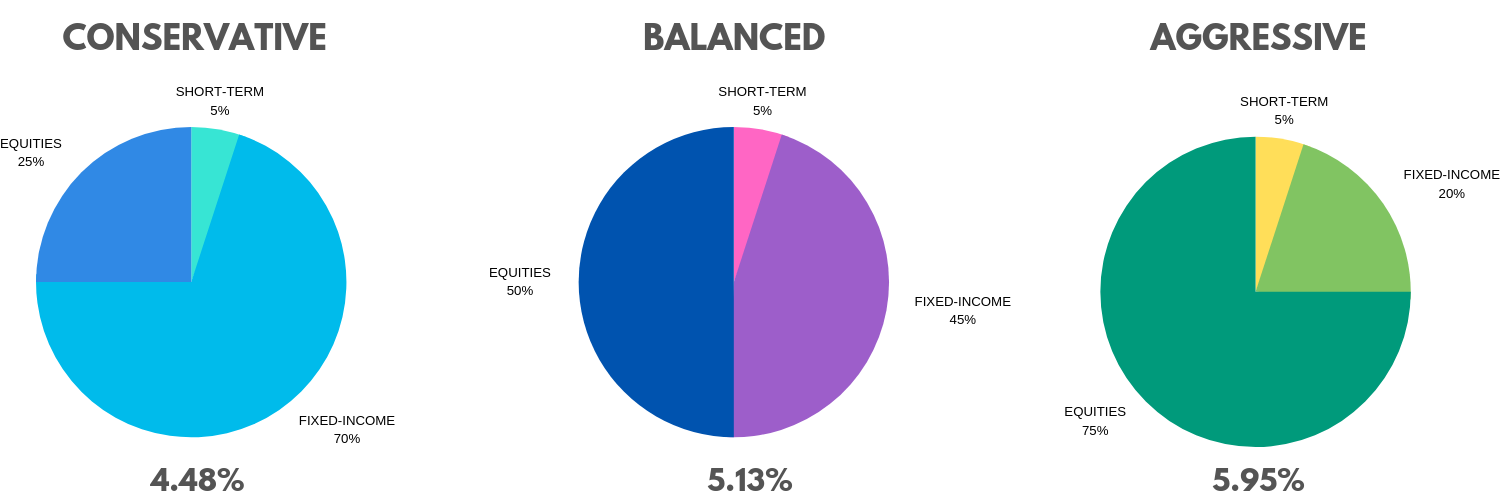

Taking a look at three model portfolios from the “Projection Assumptions Guidelines” published by the Financial Planning Standards Council every year, they estimate that one can expect to earn approximately 4.5% on a conservative portfolio, 5.1% on a balanced and nearly 6% on an aggressive portfolio. These are the assumptions that as Certified Financial Planner® professionals we adhere to for planning and projection purposes.

Note: returns are before fees.

In summary, the general consensus among the industry is that 4%-6% for a balanced portfolio on an average annual basis is deemed reasonable.

That being said, there is no “one size fits all” approach to investing. Your portfolio and your returns should reflect your unique financial situation and long-term goals. The most important numbers should not be the day-to-day, but the year-to-year, even decade to decade in some cases.

If you have any questions or concerns about your portfolio, please contact our team.

Read next: Why you should be tracking your net worth, Essential Tax Numbers 2019, The Markets: 2018 Review & 2019 Outlook.

Posted In: Investing Essentials