Monthly Market Snapshot – November

October proved to be another challenging month for equity markets, with both Canadian and U.S. stocks experiencing declines, measured in USD. The S&P/TSX Composite Index fell for the third consecutive month, while the S&P 500 Index fell into correction territory. Investors have taken a risk-off approach amid rapidly rising U.S. Treasury yields, elevated geopolitical risks, and expectations that interest rates will remain higher for longer.

Canada’s benchmark S&P/TSX Composite Index was 3.4% lower in October, as all but one of the underlying sectors were negative during the month. The health care sector was the biggest drag on the index, with a decline of 12.8% in October. Real estate, information technology and utilities fell by 6.3%, 6.2% and 4.7%, respectively. Consumer staples was the only positive sector, gaining 3.7%. Small-cap stocks, as measured by the S&P/TSX SmallCap Index, fell 2.7% for the month.

The U.S. dollar rose by 2.2% versus the loonie during the month, boosting returns of foreign markets from a Canadian investor’s standpoint. Note that all returns in this paragraph are in CAD terms. U.S.-based stocks, as measured by the S&P 500 Index, rose 0.2% in October. Seven of the underlying sectors were in the red for the month, with energy and consumer discretionary as the leading detractors, falling 3.8% and 2.2%, respectively. Utilities was the top-performing sector, gaining 3.7%. International stocks, as measured by the FTSE Developed ex-US Index, declined 2.0% during the month, while emerging markets fell 1.4%.

The investment grade fixed income indices we follow posted mixed returns in October. Canadian investment grade bonds, as measured by the FTSE Canada Universe Bond Index, rose 0.4% during the month, while the key global investment grade bond benchmark and global high-yield issues both fell 1.2%.

Turning to commodities, natural gas prices rose 22.1% during the month, while the price of a barrel of crude oil fell 10.8%. Copper declined 2.4%, while silver and gold had a positive month, rising 2.2% and 7.9%, respectively.

Inflation in Canada fell to 3.8% year-over-year in September, led by declines in costs for food and durable goods. The Canadian economy created 63,800 jobs in September, as the nation’s unemployment rate stood at 5.5%. At its October 25 meeting, the Bank of Canada left its key interest rate unchanged at 5% for the second consecutive month.

U.S. nonfarm payrolls increased by 336,000 in September, as the unemployment rate stood at 3.8%. The consumer price index remained steady at 3.7% year-over-year in September. The U.S. personal consumption expenditures price index increased 0.4% month-over-month. The Federal Reserve held its benchmark rate steady in October at a target range of 5.25% to 5.50%.

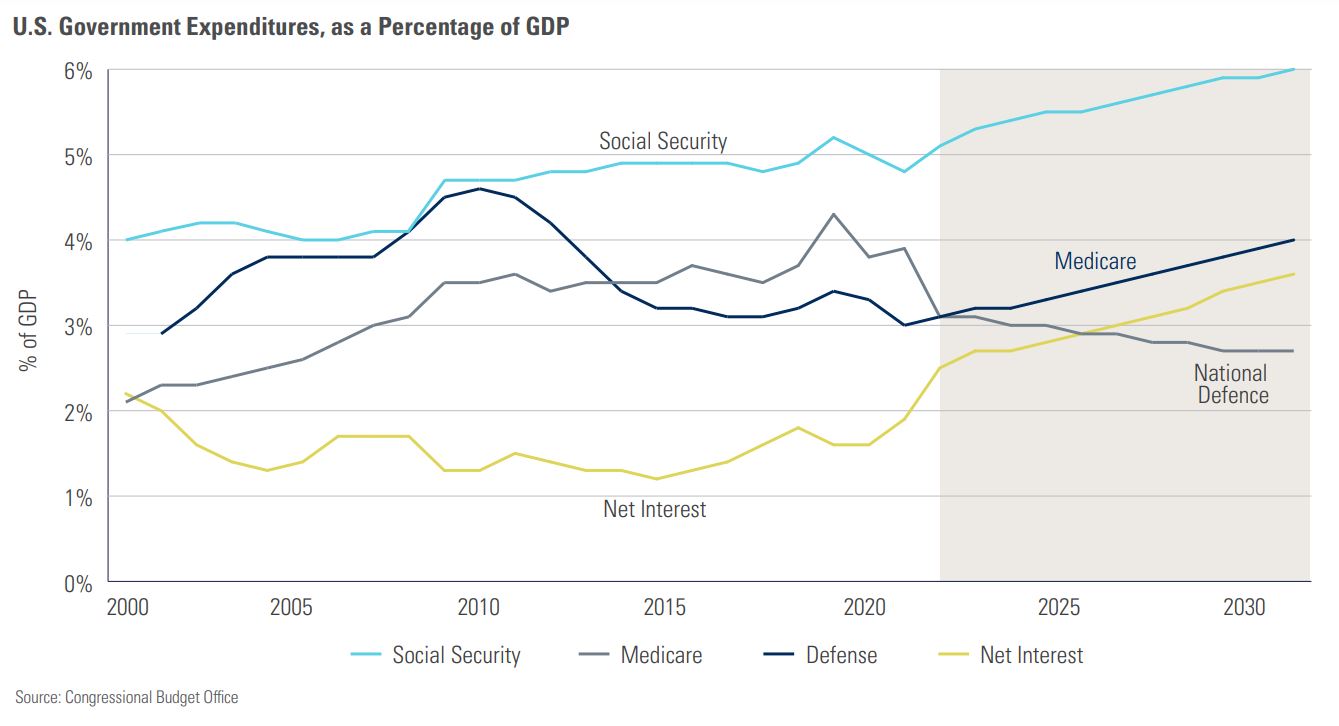

Chart of the Month

The U.S. resolved its debt ceiling crisis earlier this year (temporarily, at least), but potentially larger fiscal threats are on the horizon. Interest expenses on the nation’s US$34 trillion national debt are increasing due to higher interest rates and a rapid expansion in the amount of debt itself. According to the Congressional Budget Office, interest costs could nearly double as a percentage of GDP from 1.9% in 2023 to 3.6% by 2033. Higher debt-servicing costs could crowd out other spending initiatives in the federal budget. As illustrated by the chart above, net interest expense is projected to exceed spending on national defense by 2028, and it could get very close to what the country spends annually on Medicare by the same time. High rates and higher debt levels will only exacerbate this issue over time. The U.S. is going to need to take a big dose of medicine to solve this issue, and whatever that might look like, it’s going to be awfully bitter-tasting for the voting population. The question is whether leadership will have the fortitude to deliver it.

Posted In: Market Updates