Coronavirus, Market Volatility & Your Portfolio

The COVID-19 (coronavirus) outbreak has knocked nearly everyone's 2020 outlooks off track and while we do not know what the rest of the week, month or year has in store (no one does), we would like to remind you that sometimes the best course of action during turbulent times is no action.

"I don't want to invest my money now because..."

There's always going to be a reason. The below chart highlights the major causes of investor concern year-by-year for the past 9 decades. You will notice that at the end of the day, the market continues to rise over the long-term and recovers from every major event.

Source: DJIA – Dow Jones Industrial Average

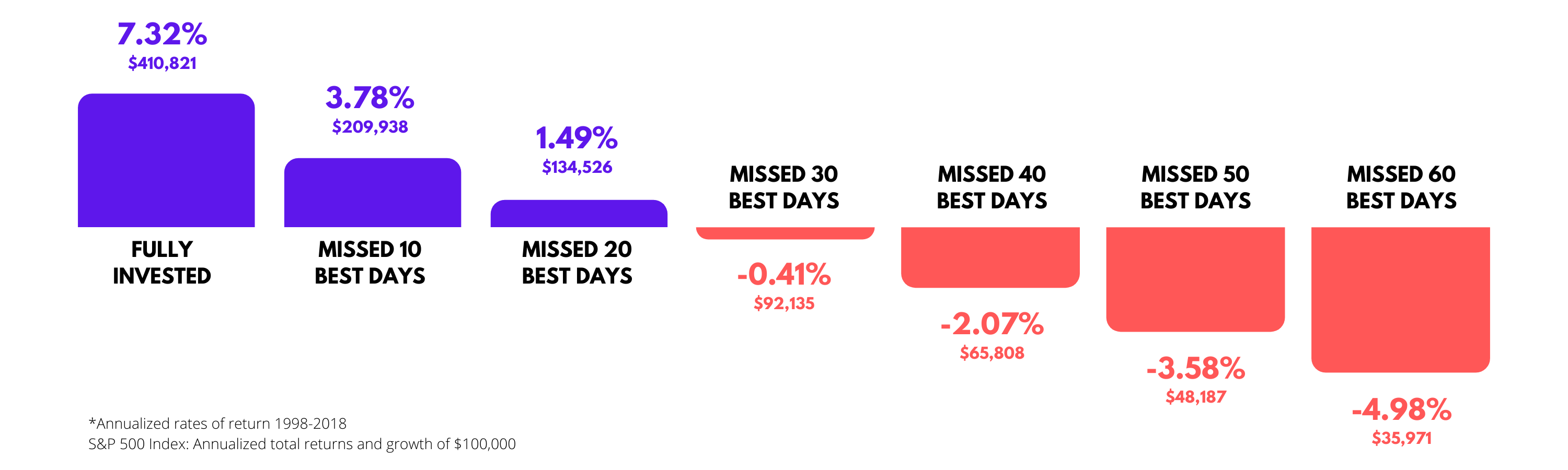

Missing even the 10 best days in the market reduced returns by almost 50% in the last 20 years...

Market volatility is an inevitable and inherent part of investing and when you make emotional buy-and-sell decisions you risk missing opportunities for growth and recovery.

Sources: Bloomberg L.P., as of 12/31/18. Invesco Canada Ltd.

Best days also typically come near the worst. Despite 2008 being in the center of the Great Recession, it had 7 of the 20 best price return days for the Dow Jones Industrial Average Index since 1945.

When markets are volatile, it’s natural to be worried about the impact on your portfolio. And when you’re worried, you may feel inclined to reduce positions. However, by sticking to your investment plan and remaining in a diversified portfolio you are likely already in the best possible position to weather market storms. If you have any questions or concerns about your portfolio, please contact our office. We thank you for the continued trust you place in our team.

______________________________________________

Disclaimer: This blog post is provided as a general source of information and should not be considered personal legal, accounting, tax or investment advice, or an offer or solicitation to buy or sell securities. Market conditions may change which may impact the information contained in this document. All charts and illustrations are for illustrative purposes only. They are not intended to predict or project investment results. Past performance does not guarantee future results.

Posted In: Market Updates