RDSP’s – what are they? who qualifies? and more.

What is an RDSP?

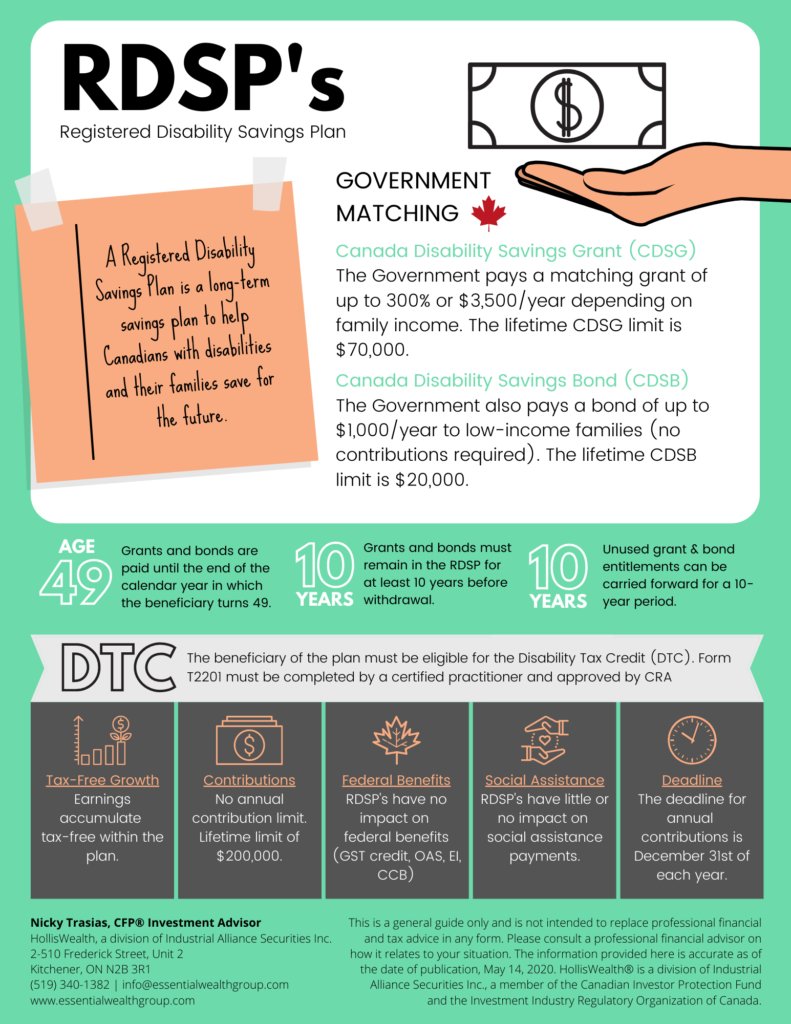

A Registered Disability Savings Plan (RDSP) is a type of savings plan that is intended to help parents or other eligible holders (see below) save for the long-term financial security of a person with an eligible disability.

Beneficiary eligibility requirements

- the beneficiary of the plan must be eligible for the Disability Tax Credit (DTC) - Form T2201 "Disability Tax Credit Certificate" must be completed by a certified practitioner and approved by CRA.

- the beneficiary must have a valid social insurance number (SIN) and be a Canadian resident when the plan is opened.

- the beneficiary must be under the age of 60 (a plan can be opened until the end of the calendar year in which they turn 59).

Who can open an RDSP?

- the beneficiary (must consider age - cannot be a minor - and if the beneficiary is contractually competent)

- the beneficiary's legal parent

- a legal representative including guardian, tutor, curator, public department, agency, or institution

- a qualifying family member (legal parent, spouse or common-law partner only)

A holder who is not the beneficiary of the plan does not need to be a Canadian resident but must have a valid SIN or Business Number (for public institutions, departments or agencies).

An RDSP can have more than one plan holder (for example both parents can be co-holders).

Contribution limits

There is no annual contribution limit but there is a lifetime maximum of $200,000. Contributions are permitted until December 31st of the year in which the beneficiary turns 59.

Available grants/bonds

- The Government of Canada will pay a Canadian Disability Savings Grant (CDSG) on contributions to the plan.

- contributions are eligible to receive grant up until the end of the calendar year in which the beneficiary turns 49.

- the grant received can be up to 300% depending on the beneficiary's family income.

- the maximum annual amount is $3,500 (with a maximum carry-forward amount for a year of $10,500).

- the maximum lifetime grant limit is $70,000.

2. Low-income families may also be able to receive a Canada Disability Savings Bond (CDSB).

- contributions to the plan are not required to receive the bond.

- the bond may be paid into the RDSP up until the end of the calendar year in which the beneficiary turns 49.

- the amount paid depends on the beneficiary's family income.

- the maximum annual amount is $1,000 (with a maximum carry-forward amount for a year of $11,000).

- the maximum lifetime bond limit is $20,000.

Tax considerations

Contributions to the plan are not tax deductible, however; investment income and growth accumulates tax-free within the plan until withdrawn.

Payments

- Disability Assistance Payment (DAP):

A DAP is a payment that can be made at any time to a beneficiary. It includes contributions, earnings, grant and bond. The portion of the DAP coming from contributions made into the plan is non-taxable. A T4A tax slip will be issued for the remaining portion. - Lifetime Disability Assistance Payment (LDAP):

LDAP can start at anytime but must begin by the end of the year in which the beneficiary turns 60. Payments are subject to an annual maximum withdrawal limit based on a formula taking into consideration the beneficiary's life expectancy, age and the fair market value of the plan. Once payments are started they must be made annually until either the plan is terminated or the beneficiary has died. As with the DAP, the portion of the payment coming from contributions made into the plan is non-taxable. A T4A tax slip will be issued for the remaining portion.

← Check out this RDSP SAVINGS CALCULATOR from CRA to help you understand how money in an RDSP can grow over time.

Please don't hesitate to contact our team if you would like more information on disability planning.

Posted In: Disability Planning