Monthly Market Snapshot – November

Stocks around the globe were in rally mode during November with major equity indices posting their strongest monthly advances since April. Various U.S. and global stock indices hit record highs during the month, fueled by positive COVID-19 vaccine developments, giving investors hope of a return to normalcy in the near future and optimism for a strong recovery in 2021. The election of Joe Biden as the next U.S. president also heightened investor enthusiasm, as many expect the Biden presidency to be less volatile than the current administration.

Canada’s benchmark S&P/TSX Composite Index ended November up 10.3%, with all but one of the benchmark’s underlying sectors producing gains during the month. The health care, energy and financials sectors led the way with respective gains of 35.0%, 18.6% and 16.3%. Materials was the only sector in the red during the month, with a loss of 4.8%. Small-cap stocks, as measured by the S&P/TSX Small Cap Index, climbed 17.4% for the month.

The loonie was 2.4% higher versus the greenback during the month, dampening returns in foreign equity markets from a Canadian investor’s standpoint. Note that all returns cited in this and the following paragraph are in Canadian dollar terms. U.S.-based stocks, as measured by the S&P 500 Index, climbed 7.7% in November, with all but one of the benchmark’s underlying sectors in the black. The energy, financials and industrials sectors produced returns of 23.1%, 13.6% and 12.5%, respectively. Utilities was the only sector to yield a negative return during the month, with a loss of 2.5%. International stocks, as measured by the MSCI EAFE Index, gained 12.2% in November, while emerging markets improved by 6.2%.

The investment grade fixed income indices we follow were all higher in November. Canadian investment grade bonds, as measured by the FTSE Canada Universe Bond Index, finished with a 1% gain for the month, while the key global investment grade bond benchmark was 1.8% higher. Global high-yield issues advanced 3.8% during the period.

Turning to commodities, the price of crude oil climbed 26.7% during the month amid a surprise decline in U.S. crude supplies along with optimism surrounding COVID-19 vaccine breakthroughs. Natural gas, meanwhile, fell 14.1% during the month. The price of gold and silver slid 5.5% and 4.7%, respectively, during the period.

Canadian gross domestic product rose at an annualized rate of 40.5% in the third quarter, rebounding from the previous quarter’s 38.1% decline. Canada added 83,600 jobs in October, as the nation’s unemployment rate fell to 8.9%. Canadian inflation rose 0.7% year-over-year in October. The Bank of Canada kept its benchmark rate steady at 0.25% and stated it has no plans to change the policy rate until its 2% inflation target is sustainably achieved.

A second estimate for U.S. gross domestic product showed a 33.1% expansion in the third quarter. Personal consumption increased 40.6% over the same period. Nonfarm payrolls rose by 638,000 in October, as the unemployment rate fell to 6.9%. U.S. consumer prices and core CPI were unchanged in October. The U.S. Federal Reserve held short-term borrowing rates near zero, stating economic activity remains well below levels prior to the coronavirus pandemic.

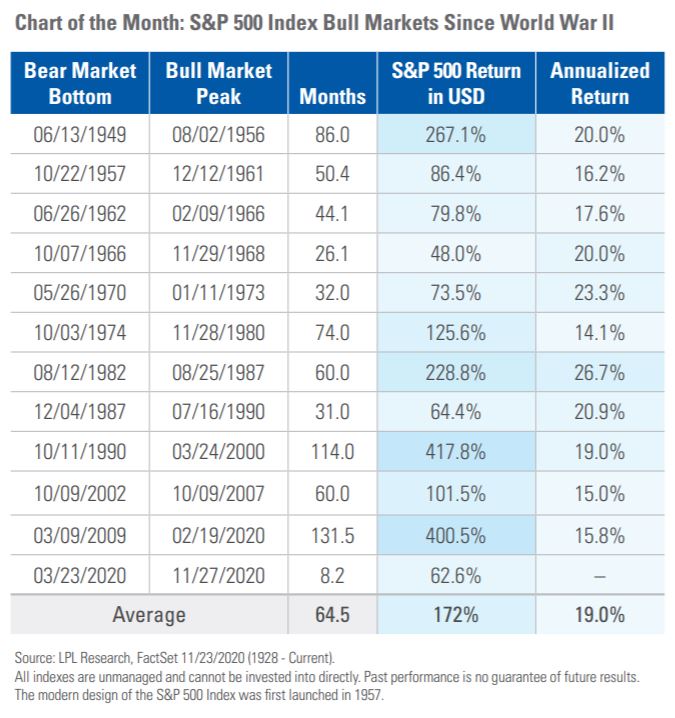

It has been a swift and dramatic rebound for equities since the abrupt fall at the beginning of the coronavirus pandemic earlier this year. After plummeting over 40% in just a month’s time (this, and other figures cited are in USD terms), the S&P 500 Index has soared, gaining over 60% since its low on March 23. More recently, the index reached a new record high on November 27, as COVID-19 vaccine breakthroughs fuelled optimism for a strong economic recovery. And it is possible there could be a lot of life left in this run for stocks. When looking at previous bull markets since World War II, the average duration has been close to five years, according to LPL Research. With the current bull market only a couple of months in, there could be a lot more gains to come for equities, if history is any indication.

Posted In: Market Updates