Monthly Market Snapshot – February

Major equity benchmarks around the globe ended February in positive territory despite bouts of turbulence during the second half of the month. Stock market performance to start the month was solid as vaccination rollout plans strengthened investor optimism for a large-scale reopening of the economy later this year. Fears that a rapid recovery would lead to higher inflation and possibly accelerate policy tightening, however, rattled bond markets and led to a sharp sell-off for government bonds towards the end of the month. This also led to weaker stock prices as February drew to a close.

Canada’s benchmark S&P/TSX Composite Index ended February up 4.2%, as sectors most sensitive to the economic cycle performed strongly. The energy and financials sectors, which make up more than 40% of the index, finished the month up 8.5% and 6.7%, respectively. Technology and consumer discretionary were the top-performing sectors for the month with respective gains of 9.9% and 8.7%. Utilities and materials stocks witnessed the sharpest declines during the month, falling 5.7% and 4.5%, respectively. Small-cap stocks, as measured by the S&P/TSX Small Cap Index, climbed 9.4% for the month.

The loonie was 0.3% higher versus the greenback in January, slightly dampening returns in foreign markets from a Canadian investor’s standpoint. Note that all returns cited in this and the following paragraph are in CAD terms. U.S. stocks, as measured by the S&P 500 Index, were 1.9% higher in February. The energy and financials sectors led the way with respective gains of 20.6% and 10.6%. Utilities stocks had the steepest decline during the month, falling 7.2%. International stocks, as measured by the MSCI EAFE Index, were up 1.4% for the month, while emerging market equities were flat.

10-year U.S. Treasury yields jumped 32 basis points in February, while 10-year Government of Canada bond yields rose 47 basis points, as bond investors worried about the potential for inflation. Canadian investment grade bonds, as measured by the FTSE Canada Universe Bond Index, finished with a 2.5% loss for the month, while the key global investment grade bond benchmark was 1.7% lower. Global high-yield issues experienced a marginal gain of 0.2% during the period.

Turning to commodities, the price of crude oil continued to climb, rising 17.8% in February, surpassing US$60/barrel during the month. Natural gas gained 8.1% during the month. The price of gold slid 6.4%, while silver fell 1.9% in February. Canadian gross domestic product expanded at an annualized rate of 9.6% in the fourth quarter. Inflation in Canada picked up slightly in January, as Canadian consumer prices rose 1% year-over-year. Canadian employment fell by 212,800 in January, as the nation’s unemployment rate increased to 9.4%.

U.S. GDP growth was revised upward a tenth of a percentage point to 4.1% for the fourth quarter. U.S. nonfarm payrolls increased by 49,000 in January, as the unemployment rate fell to 6.3%. U.S. consumer prices rose 0.3% in January. U.S. personal spending rose 2.4% month-over-month in January, while personal income rose 10% from the previous month.

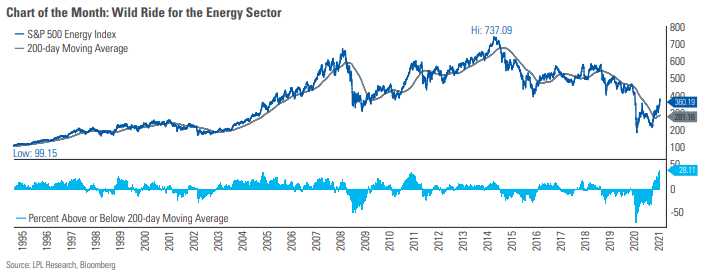

It’s been a wild ride for the energy sector over the last year. The S&P 500 Energy Index tumbled over 50% from February 5 to March 18, 2020, as the coronavirus pandemic and the breakdown between OPEC+ and Russia caused oil prices to plummet. The sector has rebounded since then, up over 70% from the March low, and is trading close to 30% above its 200-day moving average – the most ever going back three decades. While this may seem like a bearish technical indicator, the sector has historically produced above-average returns during the year following a period when it trades at 20% or more above its 200-day moving average, according to LPL Research. In other words, momentum often breeds more momentum. Considerable uncertainty remains due to COVID-19, but if history is any indication, the energy sector could continue its momentum for the foreseeable future.

Posted In: Market Updates