Converting your RRSP to a RRIF

As you approach retirement, you'll need to start thinking about how you're going to fund this next phase in your life.

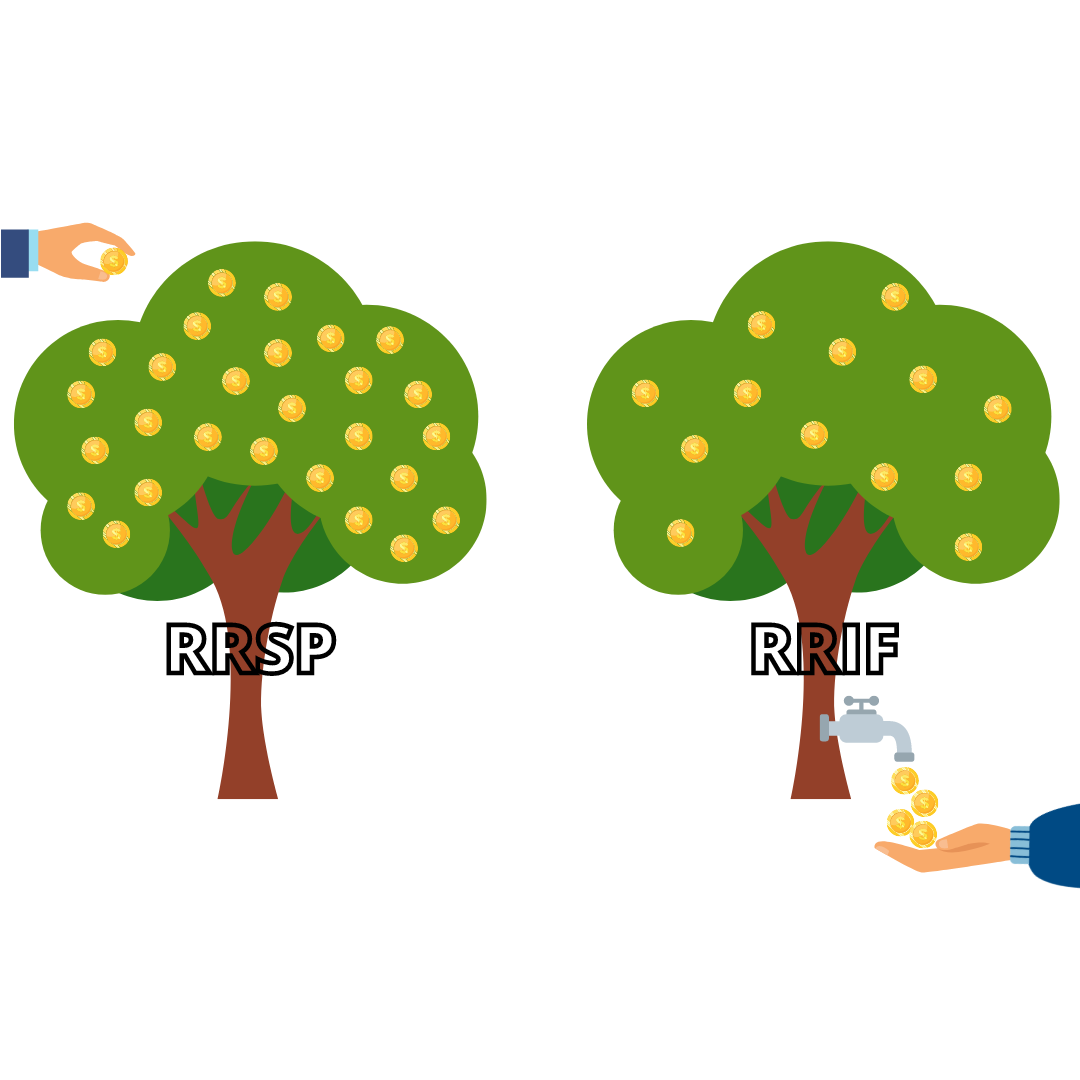

Most Canadians choose to open a Registered Retirement Savings Plan (RRSP) for this purpose, which they make contributions to during their working years.

Think of a Registered Retirement Income Plan (RRIF) as an extension of your RRSP. When you are ready to start taking income from your RRSP in retirement, it gets converted to a RRIF. This conversion must take place before the end of the calendar year in which you turn 71 at the latest.

You must make a minimum withdrawal from your RRIF annually based on a government-prescribed formula but are free to take more (with no maximum cap) if you wish. These payments are taxed fully as income - the tradeoff for the tax-deductibility of your contributions into the RRSP in previous years.

Your RRIF may continue to hold investments, just as your RRSP did, allowing you to participate in the market throughout your retirement years at a risk level that's suitable for you.

If you're starting to think about retirement, contact our office. Together, we will develop a plan that supports your retirement lifestyle and generates income in a tax-efficient manner so that you can enjoy this exciting new chapter.

Posted In: Retirement