DCAF. How do you take your investments?

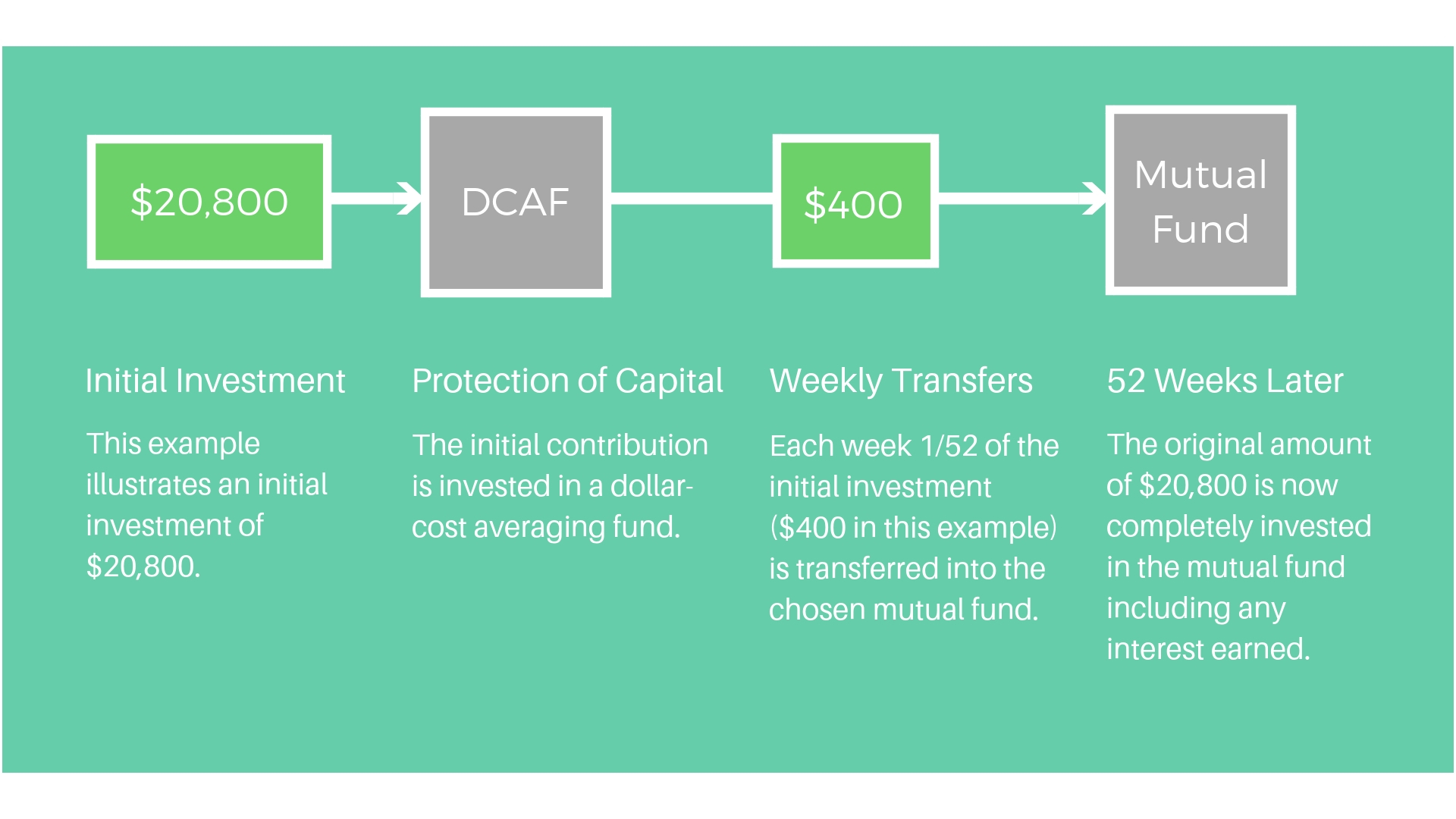

What is DCAF? No, we're not talking about your morning cup of joe. We're talking about dollar-cost averaging funds and why they can be an effective investment strategy.

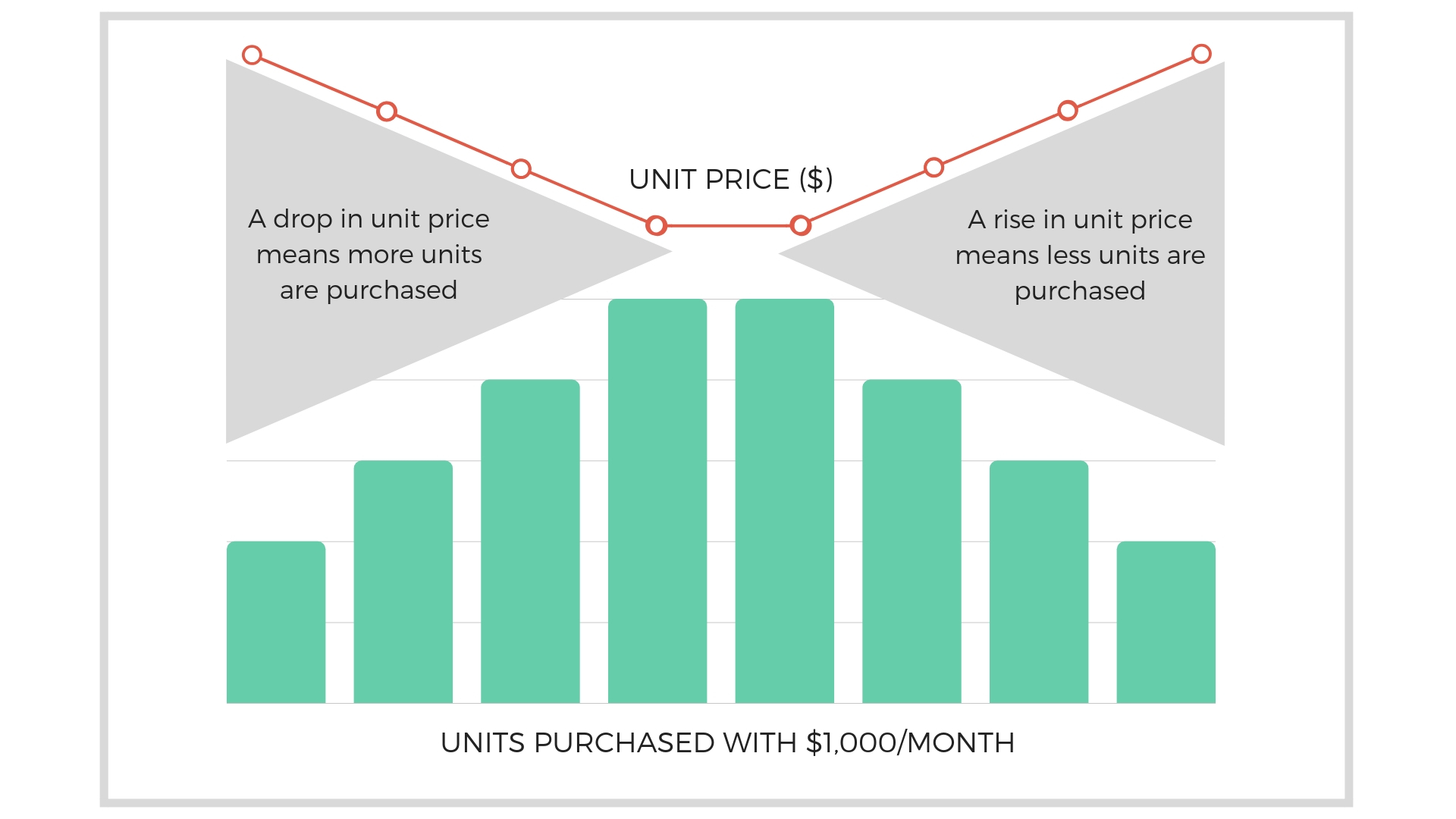

Dollar-cost averaging is best used during volatile markets, not unlike what we have witnessed going into the tail end of 2018. It helps to reduce the risk of timing a single-sum investment by investing a fixed dollar amount at regular intervals. The “dollar cost averaging” process helps control the effect of market volatility by smoothing out the average cost per investment unit purchased which in turn can result in a lower average price and therefore a higher capital gain.

How it works Overall dollar-cost averaging is a relatively simple concept offering a strategic and systematic way to invest without the challenge of trying to time the market. Contact your Essential Wealth Group team to learn more.

Overall dollar-cost averaging is a relatively simple concept offering a strategic and systematic way to invest without the challenge of trying to time the market. Contact your Essential Wealth Group team to learn more.

Posted In: Investing Essentials