Emotional investing

When something is threatening us, experience tells us to get away as quickly as possible. That’s a prudent reaction when dealing with bears, avalanches and hurricanes, but it’s not so helpful when it comes to investing.

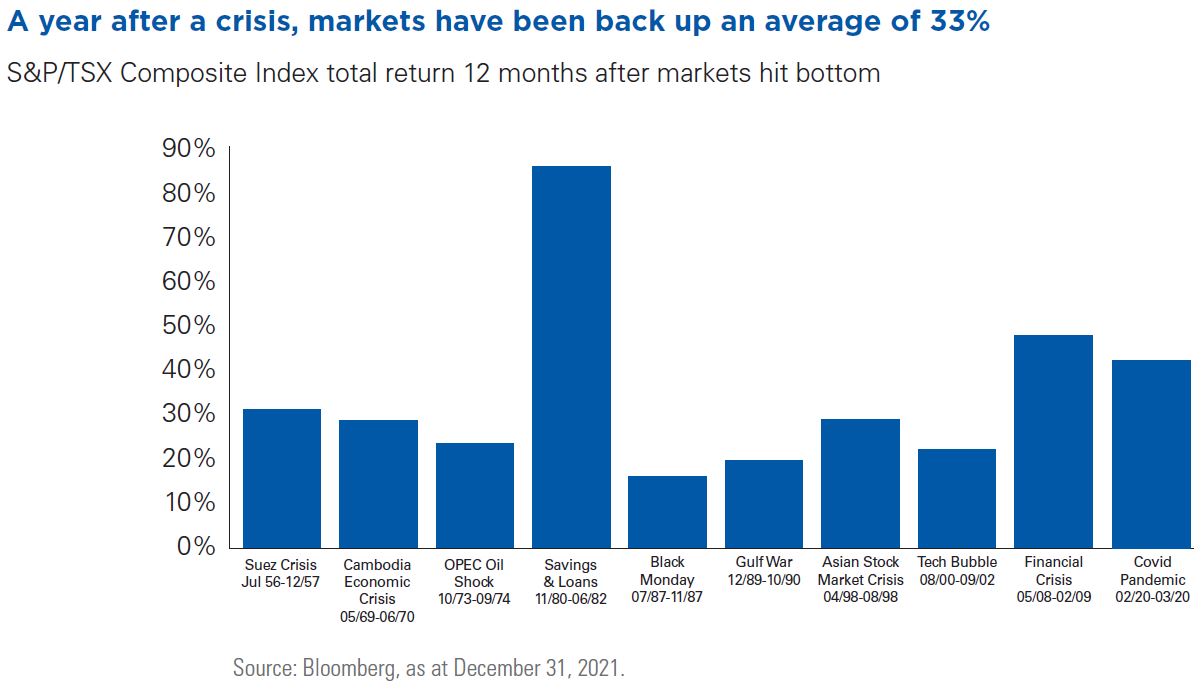

Markets bounce back

When markets drop, our first instinct may be to sell immediately. But that’s often the worst thing to do.

In fact, by the time we’re feeling that urge to sell, it’s probably already too late to limit the damage. And the period right after a market drop is often the most profitable. This is when portfolio managers typically buy more of the stocks they believe in, because those stocks are now bargains.

And when the market recovers, it’s often in vigorous fashion, as the chart below shows.

By selling when your investments are dropping, you’re locking in a loss and missing the possible run up to pre-decline or higher prices.

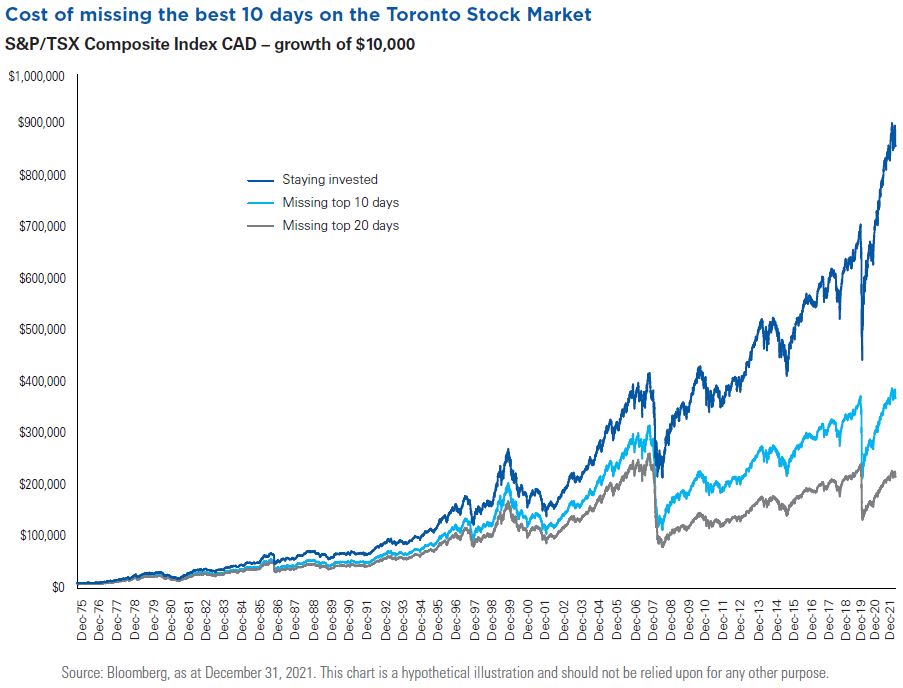

Selling in and out of the market based on fears and optimism will likely mean you'll be sitting on the sidelines on some of the best days. The chart below illustrates the potential effect.

A better strategy may be to stay invested and focus on the long-term, rather than react to the ups and downs of the market. This is where we can help.

Our team is here to discuss how your portfolio fits with your risk tolerance, how it would likely be affected by a major market correction, and what built-in protections there are.

Contact us to review any questions or concerns.

Posted In: Market UpdatesInvesting Essentials