Monthly Market Snapshot – 2020 Year-End

Stocks continued to rally in the final month of the year, notwithstanding rising COVID-19 cases, a new coronavirus variant identified in the United Kingdom, and further lockdowns affecting the holiday season. A successful COVID-19 vaccine rollout and the signing of the second-largest federal stimulus package in the U.S. aided market sentiment and sent major equity indices to all-time highs to close out 2020.

Despite the challenges earlier in the year, which included the global economy coming to an abrupt halt and the accompanying equity market free fall, 2020 produced double-digit returns for many of the major equity markets, not to mention very healthy returns for broader fixed income benchmarks. On the year, the S&P/TSX Composite Index gained 2.2%, while the S&P 500 Index advanced 14.4% in Canadian dollar terms. The MSCI World Index was up 12.2%, in CAD terms.

Turning to the year’s final quarter, the Canadian equity benchmark climbed 8.1%. Nine of the 11 underlying sectors of the S&P/TSX Composite produced positive returns during the period, led by the health care and consumer discretionary sectors, with respective gains of 29.9% and 20.4%. The allimportant financials and energy sectors, which account for nearly half the value of the Canadian index, finished the quarter 15.4% and 13.0% higher, respectively. Consumer staples and materials were the only sectors not to produce a positive return during the quarter, with respective losses of 6.0% and 4.0%. Canadian small-cap stocks surged in Q4, as the S&P/TSX Small Cap benchmark gained 22.8%.

The loonie jumped 4.6% versus the greenback during the final three months of the year, which dampened returns in foreign markets from a Canadian investor’s standpoint. Note that all returns in this and the following paragraph are in CAD terms. U.S. stocks, as measured by the S&P 500 Index, finished the fourth quarter 7.1% higher. Energy, financials and industrials led the way with respective gains of 20.7%, 17.5% and 10.5%. Real estate was the lone sector in the red in Q4, with a marginal loss of 0.2%. International stocks produced solid returns in the fourth quarter, as the MSCI EAFE Index gained 11.0%. Emerging market stocks climbed 14.5% during the period.

Canadian investment grade bonds, as measured by the FTSE Canada Universe Bond Index, produced a 0.6% gain in Q4, and finished 8.7% higher for 2020. The key global investment grade bond benchmark rose 3.3% during Q4 and ended the year up 9.2%. Global high-yield issues gained 6.0% for the quarter and finished 5.8% higher for the year.

Turning to commodities, the price of a barrel of oil rose 20.6% in Q4. Oil, however, is still down close to 20% for the year as it has not fully recovered from the effects of the coronavirus pandemic, along with the OPEC+ breakdown, that sent oil prices plummeting back in Q1. Natural gas prices were fairly muted in Q4 and ended the year up 16.0%. Gold produced a 0.4% gain during the quarter and finished the year 24.4% higher. Silver produced a 12.4% gain in Q4, which helped the commodity post a 47.4% return during 2020.

Canada added 62,100 jobs in November, as the nation’s unemployment rate fell to 8.5%. Canadian inflation rose 1% in November from a year earlier. The Bank of Canada kept its benchmark rate steady at 0.25% in its December meeting and reiterated its commitment to keep rates at historic lows to support the economy.

U.S. nonfarm payrolls rose by 245,000 in November, as the unemployment rate fell to 6.7%. U.S. consumer prices rose 0.2% month-over-month in November. The Federal Reserve left interest rates near zero at its December meeting and promised to maintain its massive asset purchase program until it sees substantial progress in employment and inflation.

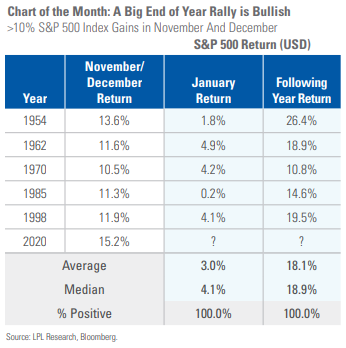

It has been a rewarding time for investors since the abrupt fall of equities at the beginning of the coronavirus pandemic. The S&P 500 Index has gained close to 70% since its low on March 23 (figures cited are in USD terms) and there was plenty of steam left in the last two months of the year, with the index up 15% in November and December. Will this momentum continue? If history is any indication, investors could be rewarded again in 2021. Since World War II, when the S&P 500 gained 10% or more in the final two months of the year, the index produced double-digit returns in the subsequent year. January was also higher in each instance.

Posted In: Market Updates