Monthly Market Snapshot – August

Stocks rose across the U.S. and Canada as investors took a risk-on approach to the capital markets with mounting hope for a soft landing – a scenario where inflation falls back to 2% without the economy dipping into a recession. U.S. stocks rallied on the back of declining inflationary pressures, expectations for the ending of the Federal Reserve’s rate-hiking cycle, and better-than-expected Q2 earnings from bellwether companies.

Canada’s benchmark S&P/TSX Composite Index was 2.3% higher in July, as eight of the underlying sectors in the index were positive during the month. The health care sector led the index with a gain of 21.0%. The much larger materials, energy and financials sectors tacked on 6.4%, 4.1% and 3.2%, respectively, in July. Telecommunication services was the worst-performing sector, declining 6.3%. Small-cap stocks, as measured by the S&P/TSX SmallCap Index, rose 6.0% for the month.

The U.S. dollar depreciated by 0.4% versus the loonie during the month, dampening returns of foreign markets from a Canadian investor’s standpoint. Note that all returns in this paragraph are in CAD terms. U.S.-based stocks, as measured by the S&P 500 Index, posted a 2.6% gain in July. All sectors were in the green in July, with energy and telecommunication services leading the benchmark’s gain, rising 6.8% and 6.2%, respectively. International stocks, as measured by the FTSE Developed ex-US Index, gained 2.9% during the month, while emerging markets rose 5.2%.

The investment grade fixed income indices we follow were mixed in July. Canadian investment grade bonds, as measured by the FTSE Canada Universe Bond Index, decreased by 1.1% during the month, while the key global investment grade bond benchmark rose 0.7%. Global high-yield issues gained 1.4%.

Turning to commodities, natural gas prices fell 5.9% during the month, while the price of a barrel of crude oil rose 15.8%. Silver, gold and copper all had a positive month, gaining 9.5%, 2.1% and 7.1%, respectively.

Inflation in Canada declined to 2.8% year-over-year in June, led by falling transportation costs. Inflation remained above the 2.0% target due to elevated food and shelter prices. The Canadian economy added 59,900 jobs in June, as the nation’s unemployment rate rose to 5.4%. During July, the Bank of Canada raised its policy rate by 25 bps to 5.0% as the bank continued to see excess demand and heightened core inflation.

U.S. nonfarm payrolls increased by 209,000 in June, as the unemployment rate fell to 3.6%. The consumer price index slowed to 3.0% year-over-year in June. The U.S. personal consumption expenditures price index increased 0.2% month-over-month. The Federal Reserve announced a 25-bps rate hike at its July meeting. The increase brought the U.S. policy rate to a target range of 5.25% to 5.50%, its highest level in 22 years. The U.S. economy grew 2.4% in the second quarter of 2023 from 2.0% in the previous quarter, significantly beating market expectations of 1.8%.

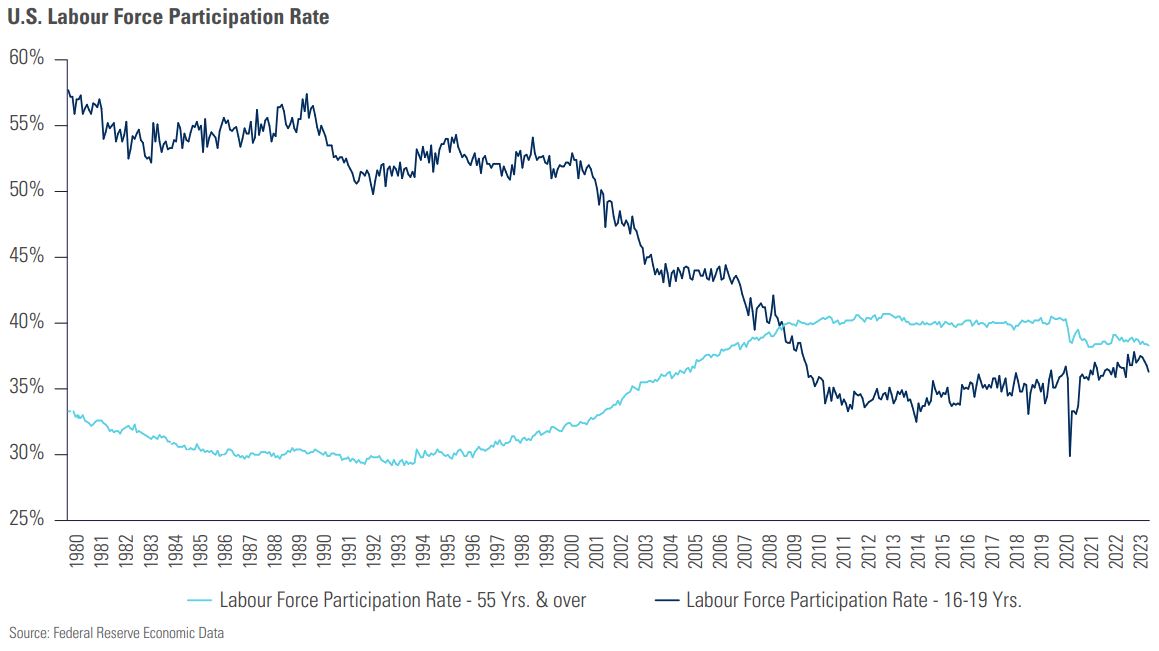

Chart of the Month: The Teens are Going Back to Work

A red-hot U.S. labour market has been a key pillar of the economy’s resilience, and with labour demand still elevated, teenagers are filling those roles. Pre-Global Financial Crisis, teens were historically more likely to be in the labour force than seniors. In August 1989, the Labour Force Participation Rate (LFPR) for teens (57.4%) was almost twice that of seniors (30.1%). Since October 2008, seniors have been more likely to be in the labour force than teens. However, in recent years, teenage participation has rebounded while seniors have started leaving the workforce. After reaching an all-time low in February 2014, the teen LFPR rose steadily, returned to pre-pandemic levels, and reached its highest level since 2009 in recent months. A few pandemic trends are driving the changes in the labour force. Many seniors retired early with inflated asset prices or left the workforce during the pandemic due to health concerns. The heightened demand for labour increased teen employment opportunities as companies became willing to employ and train teenagers. Also, joining the workforce has become more appealing, with college enrollment declining and wages increasing. As more teenagers enter the labour force, they can play a crucial role in meeting the persistent demand for labour in the U.S.

Posted In: Market Updates