Monthly Market Snapshot – December

November proved to be an exceptional month for both stocks and bonds as the expectation that the Federal Reserve is nearing the conclusion of its hiking cycle became further embedded. Investors digested more economic data that pointed towards a soft landing for the U.S. economy, including higher-than-expected U.S. Q3 GDP growth and a further drop in inflation. The S&P 500 Index performed remarkably well, marking its second-best November in the last four decades.

Canada’s benchmark S&P/TSX Composite Index was 7.2% higher in November, as all of its underlying sectors were positive during the month. The information technology sector was the largest contributor to the index return, with a rise of 27.3% in November. The financials, real estate and telecommunication services sectors also rose by 9.8%, 7.8% and 7.1%, respectively. Small-cap stocks, as measured by the S&P/TSX SmallCap Index, were up 4.6% for the month.

The U.S. dollar fell by 2.3% versus the loonie during the month, dampening returns of foreign markets from a Canadian investor’s standpoint. Note that all returns in this paragraph are in CAD terms. U.S.-based stocks, as measured by the S&P 500 Index, rose 6.6% in November. All but one of the underlying sectors were in the green for the month, with the information technology and real estate sectors as the leading contributors, gaining 10.3% and 9.9%, respectively. Energy was the only sector in the red, falling 3.7%. International stocks, as measured by the FTSE Developed ex-US Index, rose 7.2% during the month, while emerging markets gained 4.3%.

The investment grade fixed income indices we follow were up in November. Canadian investment grade bonds, as measured by the FTSE Canada Universe Bond Index, rose 4.3% during the month, while the key global investment grade bond benchmark and global high-yield issues were up 5.0% and 4.8%, respectively.

Turning to commodities, natural gas prices fell 21.6% during the month, while the price of a barrel of crude oil fell 6.2%. Copper, silver and gold had a positive month, rising 4.9%, 10.2% and 2.2%, respectively.

Inflation in Canada fell to 3.1% year-over-year in October, led by declines in costs for food and transportation. The Canadian economy created 17,500 jobs in October, as the nation’s unemployment rate rose to 5.7%. The Canadian economy contracted by 1.1% annually in the third quarter of 2023, marking its first decline since the second quarter of 2021. The Bank of Canada’s key interest rate remained steady for the third consecutive month at 5%.

U.S. nonfarm payrolls increased by 150,000 in October, as the unemployment rate rose to 3.9%. The consumer price index fell to 3.2% year-over-year in October. The U.S. personal consumption expenditures price index was flat month-over-month, the weakest reading since July 2022. The U.S. economy expanded an annualized 5.2% in Q3 2023, marking the strongest growth since Q4 2021. The federal funds rate remained unchanged in November at a target range of 5.25% to 5.5%.

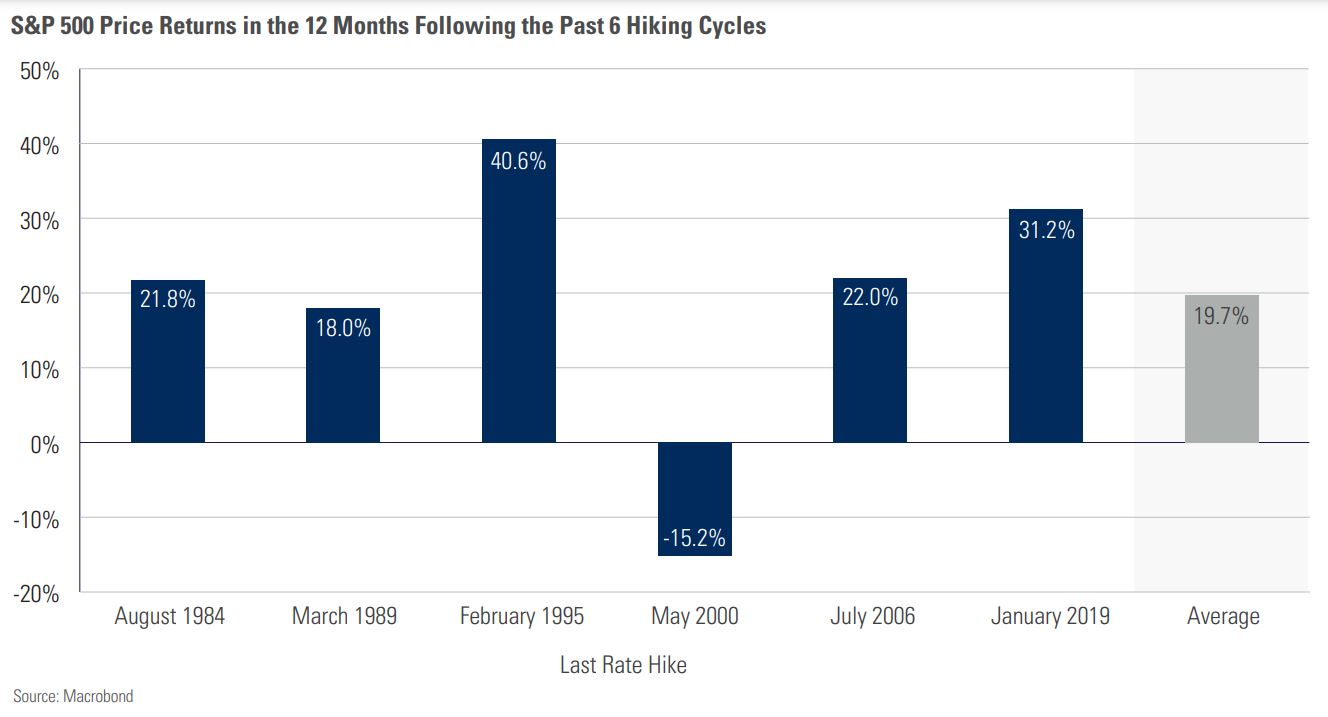

Chart of the Month: S&P 500 Price Returns in the 12 Months Following the Past 6 Hiking Cycles

Stock markets have done very well when a period of central bank rate hikes comes to a conclusion. Looking at the six hiking cycles prior to the most recent one (U.S. data used in this example), the S&P 500 surged 19.7% in the 12 months after the Fed’s final rate increase. That average would be higher if it weren’t for the decline that occurred starting in May 2000, but that drawdown coincided with the rupture of one of the biggest stock market bubbles in history, so perhaps it’s a bit of a unique case. As things stand today, the last rate hike in the U.S. kicked in on July 27. Inflation has cooled significantly since then, and futures markets are overwhelmingly betting that the Fed is done. Since the last rate hike, the S&P 500 was higher by only about 1% to November 30 (about four months). If July 27 was indeed the last hike, and if the last 40 years of history are a guide, the next eight months could be particularly constructive for equity investors.

Posted In: Market Updates