Monthly Market Snapshot – January

Equity markets rose in December, capping off what was a stellar year for stocks. The enthusiasm was driven by excitement related to the applications of artificial intelligence, the U.S. economy’s resilient growth and slowing inflation, and a view that the Fed’s rate hiking cycle had concluded and rate cuts were likely in 2024. Canadian stocks rose 8.1% in 2023, powered by a rebound in the financial sector and hopes the Bank of Canada will cut rates in 2024. The Nasdaq 100 index posted one of its best annual runs since the 1999 tech boom, gaining 51.4% in CAD terms for the year as big tech stocks rallied.

Canada’s benchmark S&P/TSX Composite Index was up 3.6% in December and rallied 7.3% in the year’s final quarter. All but one of the benchmark’s underlying sectors were positive in Q4. Leading the way were the information technology and financials sectors, which posted gains of 23.9% and 11.7%, respectively. The energy sector was the only loser in Q4, with a decline of 2.6%. Small-cap stocks, as measured by the S&P/TSX SmallCap Index, rose 5.3% for the quarter.

The U.S. dollar depreciated by 2.5% versus the loonie during the quarter, dampening the returns of foreign markets from a Canadian investor’s standpoint. Note that all returns in this paragraph are in CAD terms. U.S.-based stocks, as measured by the S&P 500 Index, rose 1.5% in December and finished the quarter higher by 8.5%. Real estate and information technology led the gains, with returns of 14.7% and 14.0%, respectively. Energy was the only sector in the red in Q4, sliding 10.1%. International stocks, as measured by the FTSE Developed ex-U.S. Index, rose 7.6% during the quarter, while emerging markets gained 3.5%.

The investment grade fixed income indices we follow were positive in Q4. Bond prices rallied while rates came down aggressively. Canadian investment grade bonds, as measured by the FTSE Canada Universe Bond Index, were up 8.3% during the quarter. The key global investment grade bond benchmark rose 8.1%, while global high-yield issues were up 7.5% in Q4.

Turning to commodities, natural gas prices shed 14.2% during the quarter, while the price of a barrel of crude oil declined 21.1% in the same period. Gold, copper and silver all had a positive quarter, with gains of 12.1%, 4.1% and 7.3%, respectively.

Inflation in Canada was unchanged at 3.1% year-over-year in November. The Canadian economy created 24,900 jobs in November, as the nation’s unemployment rate rose to 5.8%. The Bank of Canada continued its pause in interest rate hikes in December, leaving its key interest rate unchanged at 5.0%.

U.S. nonfarm payrolls increased by 199,000 in November, as the unemployment rate fell to 3.7%. The consumer price index fell to 3.1% year-over-year in November. The U.S. personal consumption expenditures price index fell 0.1% month-over-month, the first decline since February 2022. The federal funds rate was unchanged in December and remained at a target range of 5.25% to 5.50%. The Fed also indicated there could be three 25 basis point rate cuts in 2024.

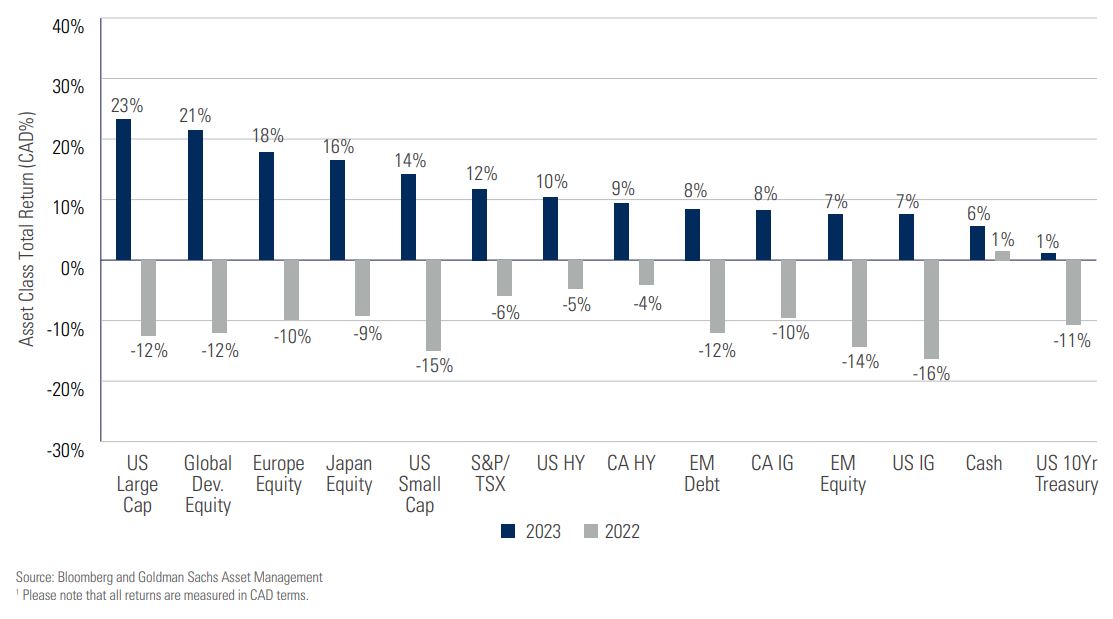

Chart of the Month

2023 was the year of the “everything rally.” Investors saw a much-needed comeback across a wide swath of asset classes on the back of moderating inflation and hopes that rates have topped out and may go lower. This followed a very challenging 2022 across the board. U.S. large-cap stocks bounced back, providing a 23%¹ return to investors, as AI enthusiasm propelled mega-cap tech stocks. Canadian stocks jumped 12%¹ as inflation slowed without triggering a full-blown recession. International stocks also rallied. Following two years of poor performance, high-yield and investment grade bonds rebounded in 2023 as yields fell late in the year due to growing confidence among investors that the central banks have finished raising rates and will potentially begin cutting rates in 2024. All of this positivity came despite the fact that most market prognosticators were very much in the bear camp as we moved into the start of 2023.

Posted In: Market Updates