Monthly Market Snapshot – July

Equity market volatility ramped up in July, as concerns about a fourth wave driven by the spread of the more contagious Delta variant tempered investor enthusiasm. Despite COVID-19 cases rising and public health authorities recommending the reintroduction of restrictive measures, stocks continued to trend upwards with North American equity indices reaching new all-time highs during the month. Share prices were supported by continued economic recovery and a positive start to the second quarter earnings season.

The S&P/TSX Composite Index showed a 0.6% improvement in July, with seven of the benchmark’s 12 underlying sectors producing gains during the month. The consumer staples, real estate and materials sectors led the way with respective gains of 7.0%, 4.4% and 3.0%. The influential financials and energy sectors posted losses of 0.2% and 5.1%, respectively. The health care sector, which accounts for only a small fraction of the overall value of the index, saw the biggest drop for the period, falling 11.1%. Small-cap stocks, as measured by the S&P/TSX Small Cap Index, retreated 2.8% for the month.

The U.S. dollar moved 0.6% higher versus the loonie in July, providing a minor boost to returns of foreign markets in Canadian dollar terms. Note that all returns in this paragraph are in CAD terms. U.S.-based stocks, as measured by the S&P 500 Index, advanced 2.8% in July. Leading the way for the U.S. stock market were the health care, real estate and utilities sectors, with respective gains of 5.3%, 5.1% and 4.8%. Energy and financials were the only sectors in the red during the month, falling 7.9% and 0.1%, respectively. International stocks, as measured by the MSCI EAFE Index, improved by 1.2% during the month, while emerging markets slid 6.5%.

The investment grade fixed income indices we follow were higher in July. Canadian investment grade bonds, as measured by the FTSE Canada Universe Bond Index, finished with a 1.0% gain for the month, while the key global investment grade bond benchmark increased by 1.3%. Global high-yield issues advanced 0.3%.

Turing to commodities, the price of a barrel of crude oil saw a marginal gain of 0.7% in July, while natural gas climbed 7.2%. The price of gold increased 2.3%, while silver slid 2.4% during the period.

Inflation in Canada decelerated to 3.1% year-over-year in June. Canadian employment increased by 230,700 in June, as the nation’s unemployment rate fell to 7.8%. The Bank of Canada left its key interest rate unchanged at 0.25% at its July meeting, indicating it does not expect any hikes before at least the second half of next year, in line with previous guidance. The U.S. economy grew at a 6.5% annual rate in the second quarter. U.S. nonfarm payrolls increased by 850,000 in June, as the unemployment rate rose to 5.9%. The consumer price index climbed 0.9% month-over-month in June, while the annual inflation figure climbed 5.4% from a year earlier. U.S. retail sales rose 0.6% in June. The Federal Reserve held interest rates in a range near zero at its July meeting and maintained asset purchases at US$120 billion a month until substantial further progress is made on employment and inflation.

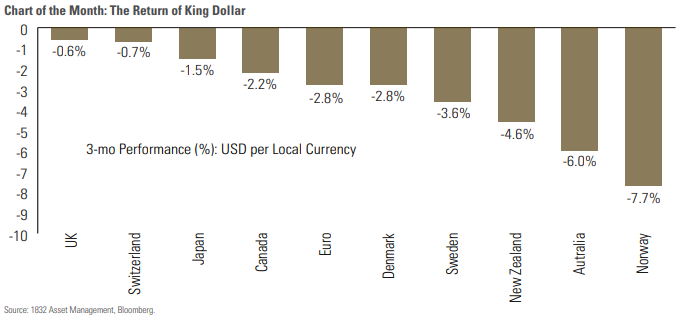

The U.S. dollar has rebounded in recent months after spending most of 2020 and the beginning of 2021 in a weakening pattern. Commodity-centric countries, including Norway, Australia and New Zealand, which have a close economic link to emerging Asian economies, have witnessed their currencies weaken the most against the greenback over the past three months as the fast-spreading Delta variant has rattled foreign exchange markets. The loonie was 2.2% lower than the greenback during this period, and remember, from the perspective of a Canadian investor, a stronger U.S. dollar provides a boost to returns of USD denominated assets held. As an example of this effect, the S&P 500 climbed 6.7% in CAD terms over the past three months compared to a 5.1% return in USD terms.

Posted In: Market Updates