Monthly Market Snapshot – June

Canada’s main stock market index fell in May, reaching its lowest level in two months. Cyclicals dragged on the TSX as oil prices weakened and investors feared that the Bank of Canada could raise interest rates further to tackle inflation. On the other side of the border, U.S. stocks rose in May, led by a rally in information technology and progress towards a debtceiling resolution. The tech rally was fueled by slowing central bank hikes and excitement surrounding artificial intelligence.

Canada’s benchmark S&P/TSX Composite Index was 5.2% lower in May, as all 11 of the benchmark’s underlying sectors were negative during the month, excluding information technology, which rose 10.1%. Materials, energy, and telecommunication services led the decline with returns of -10.7%, -8.4%, and -8.2%, respectively. Small-cap stocks, as measured by the S&P/TSX SmallCap Index, fell 4.2% for the month.

The U.S. dollar appreciated by 0.2% versus the loonie during the month, providing a slight boost to returns of foreign markets from a Canadian investor’s standpoint. Note that all returns in this paragraph are in CAD terms. U.S.-based stocks, as measured by the S&P 500 Index, eked out a 0.6% gain in May. Information technology, telecommunication services, and consumer discretionary were the only sectors in the green and led the benchmark’s gain during May, rising 9.7%, 6.6%, and 3.5%, respectively. International stocks, as measured by the FTSE Developed ex US Index, fell 3.9% during the month, while emerging markets dropped 2.0%.

The investment grade fixed income indices we follow were down in May. Canadian investment grade bonds, as measured by the FTSE Canada Universe Bond Index, decreased by 1.7% during the month, while the key global investment grade bond benchmark fell 2.0%. Global high-yield issues declined 1.1%.

Turning to commodities, the price of natural gas fell 6.0% during the month, while crude oil declined 11.3%. Silver, gold and copper all had a negative month, falling 5.6%, 1.8% and 6.0%, respectively.

Inflation in Canada rose to 4.4% year-over-year in April, with higher prices for shelter and gasoline driving the acceleration. The Canadian economy added 41,000 jobs in April, as the nation’s unemployment rate held steady at 5.0%. The Bank of Canada expects inflation to return to its two-percentage-point target by the end of 2024, but is facing pressure to increase rates as GDP expanded 3.1% in Q1, defying the central bank’s efforts to tame inflation.

U.S. nonfarm payrolls increased by 253,000 in April, as the unemployment rate improved to 3.4%. The consumer price index rose 4.9% year-over-year in April. The U.S. personal consumption expenditures price index increased 0.4% monthover-month, the strongest advance since the start of the year. The Federal Reserve announced a 25-bps rate hike at its May meeting, bringing the federal funds rate to a target range of 5.0–5.25%.

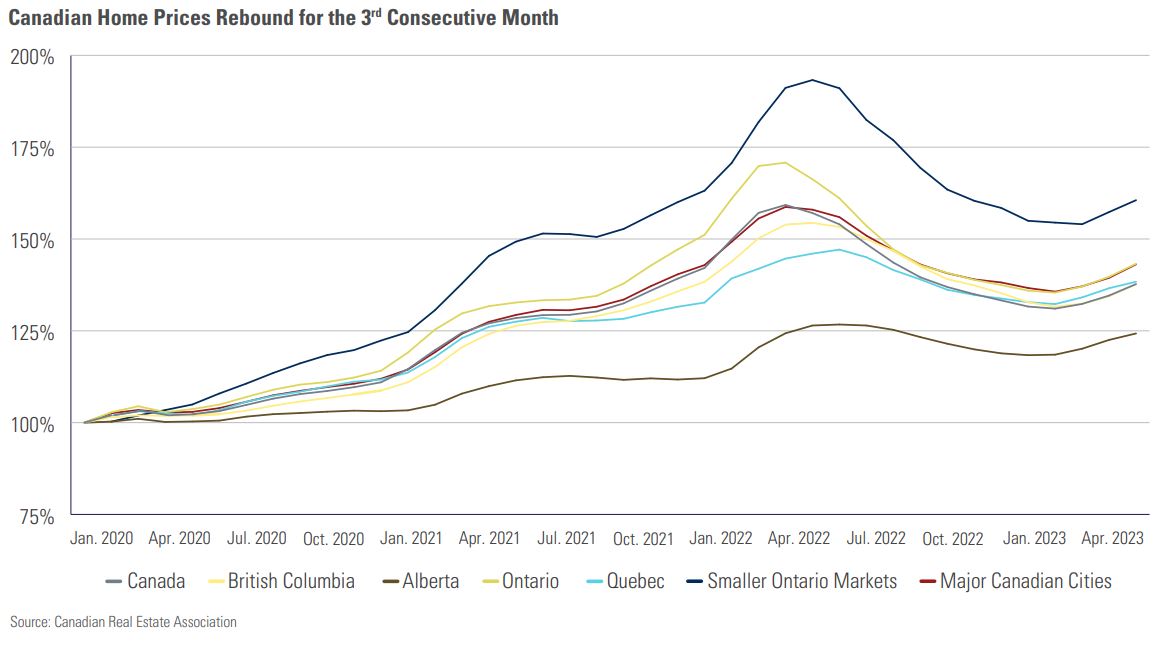

Home prices in Canada have been rising in a variety of markets after declining for a number of quarters following the Bank of Canada’s decision to begin raising interest rates. In April 2023, the Aggregate Composite MLS Home Price Index increased 1.6% month over month, marking the third consecutive month of price gains since the start of the year. There are a few explanations for the jump in prices. With the view that rates likley won’t go much higher, many buyers are now feeling confident to jump into the market and structural factors including restricted home supply, post-pandemic immigration resurgence and surplus household savings are all adding to the market upturn. Given the importance of property to the Canadian economy, some feel a recession is less probable if the housing market continues to rebound. However, rising home prices can further increase the cost of living. The recovery in home prices coupled with robust economic data could pressure the Bank of Canada to further increase rates if inflation flares up again.

Posted In: Market Updates