Monthly Market Snapshot – June

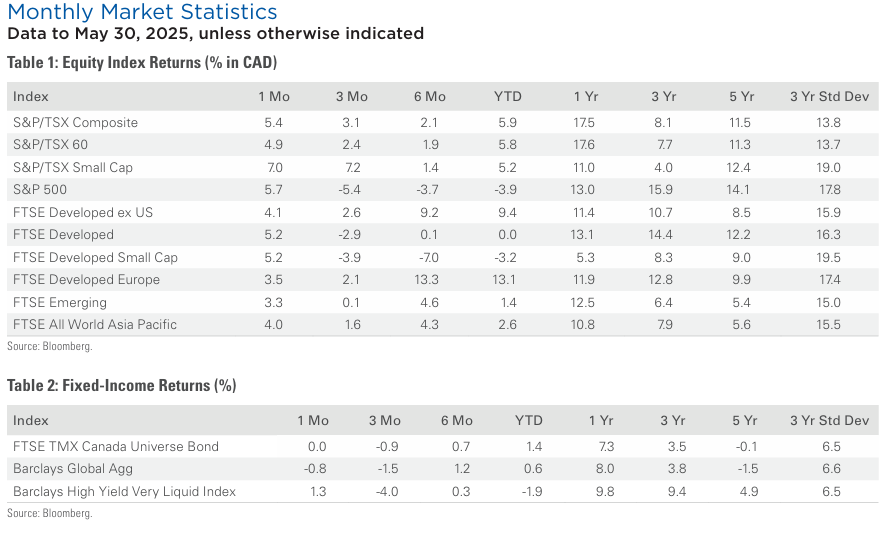

Canadian and U.S. stock markets experienced notable growth in May, thanks to easing tensions over tariffs between

the U.S. and China. Canada’s main stock index had its biggest monthly gain since November 2024, while the S&P 500

and Nasdaq had their best month since November 2023. The S&P 500 reported strong results for Q1 2025. According

to FactSet data, both the percentage of companies reporting positive earnings surprises and the magnitude of these

surprises have exceeded their 10-year averages.

Canada’s benchmark index was 5.4% higher in May, as all 11 underlying sectors were positive during the month.

The gain was led by industrials and information technology, rising 8.8% and 8.0%, respectively. Small-cap stocks, as

measured by the S&P/TSX SmallCap Index, rose 7.0% for the month.

The U.S. dollar depreciated 0.4% versus the loonie in May, lowering returns of foreign markets from a Canadian

investor’s standpoint. Note that all returns in this paragraph are in CAD terms. U.S.-based stocks, as measured by the

S&P 500 Index, gained 5.7% in May. Nine of the benchmark’s underlying sectors were in the green during the month,

with information technology leading the gains with a 10.4% return. International stocks, as measured by the FTSE

Developed ex-US Index, were up 4.1% during the month, while emerging markets rose 3.3%.

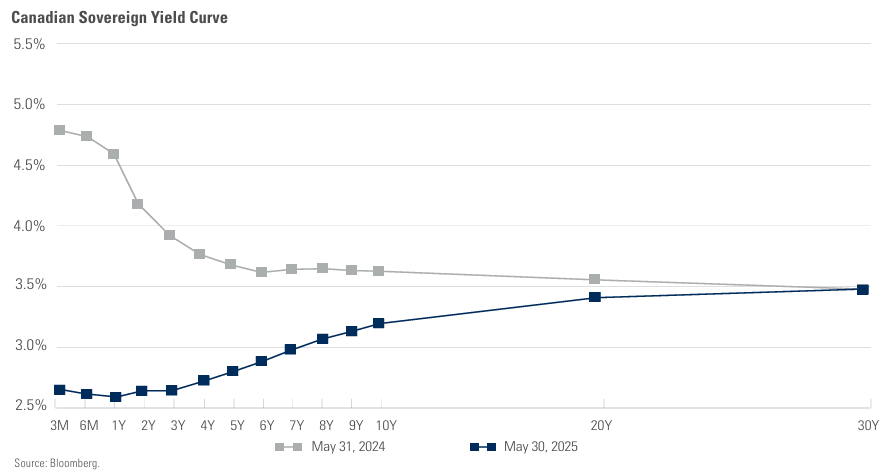

The investment grade fixed income indices we follow were mixed in May. Canadian investment grade bonds, as

measured by the FTSE Canada Universe Bond Index, remained flat during the month, while the key global investment

grade bond benchmark lost 0.8%. Global high-yield issues gained 1.3%

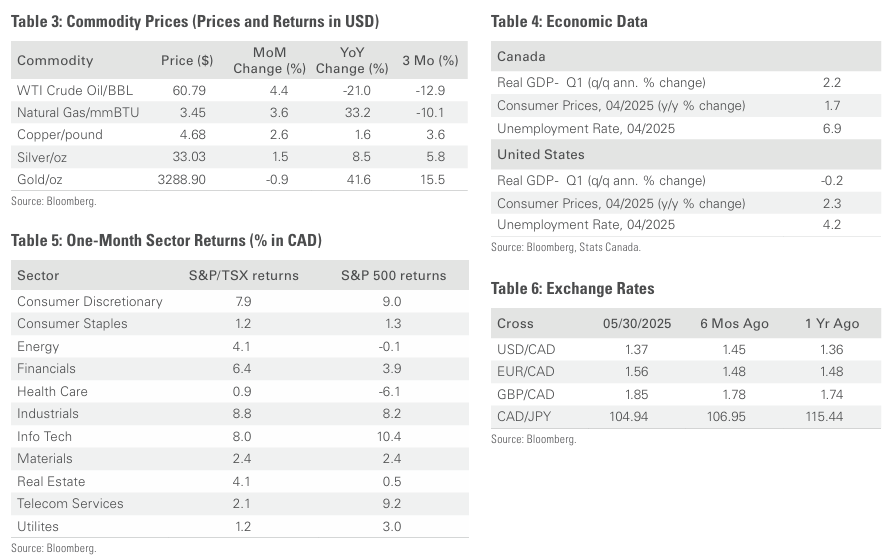

Turning to commodities, natural gas prices rose 3.6% during the month, while the price of a barrel of crude oil gained

4.4%. Copper and silver had a positive month, rising 2.6% and 1.5%, respectively, while gold fell 0.9%.

Inflation in Canada came in at 1.7% year-over-year in April. The deceleration was due to gasoline prices tumbling 18.1% y/y as the consumer carbon price was removed. The Canadian economy added 7,400 jobs in April, as the nation’s unemployment ticked up to 6.9%. The Canadian economy easily topped expectations in the first quarter of 2025, advancing 2.2% quarter/quarter annualized. GDP growth was entirely driven by inventory building and healthy export gains.

U.S. nonfarm payrolls grew by 177,000 in April, and the unemployment rate remained at 4.2%. The consumer price

index rose 0.2% in April, putting the 12-month inflation rate at 2.3%. Most of the uptick was driven by firmer services

prices, with higher shelter costs accounting for nearly two-thirds of the gain in core inflation. The Federal Reserve left

its key interest rate unchanged in a range between 4.25%-4.5%, where it has been since December.

Posted In: Market Updates