Monthly Market Snapshot – March

March capped off a strong first quarter for stocks, with major equity benchmarks hitting record highs during the quarter’s final month. Investor optimism during the quarter was buoyed by successful vaccination rollouts around the globe. However, fears of higher inflation and the possibility of accelerated policy tightening led to rising bond yields and weaker stock prices midway through the quarter. Investor enthusiasm picked up again towards the end of March as U.S. President Joe Biden unveiled his US$2.25 trillion infrastructure stimulus proposal, which would be rolled out over the next eight years.

The S&P/TSX Composite Index advanced 3.5% in March, leading to a 7.3% improvement for the index during the year’s first quarter. All but two of the benchmark’s underlying sectors were positive in Q1, led by the health care sector’s 37.8% gain, as weed stocks continued to produce solid returns. Energy and financial services stocks, which account for more than 40% of the benchmark, jumped 18.8% and 12.7%, respectively, in Q1. Materials and information technology fell 7.2% and 1.1% during the period. Canadian smallcap stocks surged 9.2% during the quarter.

The Canadian dollar was 1.4% higher versus the greenback in Q1, dampening returns from foreign equity markets for Canadian investors. Note that all returns noted in this paragraph are in Canadian dollar terms. U.S.-based stocks, as measured by the S&P 500 Index, gained 3.1% in March and finished the quarter up 4.2%. The index’s top-performing sectors for the first three months of the year were energy, financials and industrials, with respective returns of 27.3%, 13.6% and 9.3%. Consumer staples was the lone sector in the red in Q1 with a loss of 1.1%. International stocks, as measured by the MSCI EAFE Index, improved by 1.3%, while emerging markets added 0.4% during the quarter.

Long-term government bond yields climbed in Q1, leading to lower bond prices overall. Canadian investment grade bonds, as measured by the FTSE Canada Universe Bond Index, dropped 5% for the quarter, while the key global investment grade bond benchmark fell 4.5% during the period. Global high-yield issues, which are less sensitive to higher interest rates, gained 0.6% during the first quarter.

Turning to commodities, the price of a barrel of crude oil rose 21.9% in Q1. It was a year ago when the coronavirus pandemic and the breakdown within OPEC+ caused the price of oil to plunge. Since the end of March 2020, the price of WTI oil surged 190%. Natural gas gained 2.7% during the quarter. The price of gold slid 9.6%, while silver declined 7.1% during the first three months of the year.

Canadian gross domestic product expanded 0.7% month-over-month in January. Inflation in Canada picked up slightly in February, as Canadian consumer prices rose 1.1% year-over-year. Canadian employment increased by 259,200 in March, as the nation’s unemployment rate fell to 8.2%. The Bank of Canada held its policy rate at 0.25% at its March meeting.

U.S. nonfarm payrolls increased by 916,000 in March, as the unemployment rate fell to 6%. U.S. consumer prices rose 0.4% in February. U.S. personal spending fell 1% month-over-month in February, while personal income dipped 7.1% from the previous month. The Federal Reserve kept its policy rate near zero at its March meeting as Fed Chair Jerome Powell indicated current monetary policy was still appropriate and that there was no reason to push back against a surge in Treasury yields over the past month.

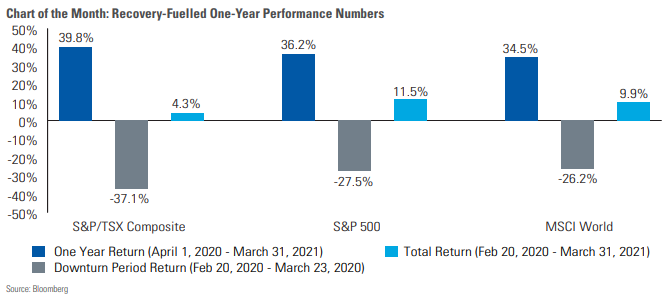

It has been just over a year since major equity indices bottomed as the claws of the COVID-19 pandemic sunk in and panic ensued. What followed was a furious rally for stocks, which resulted in some remarkable one-year performance numbers, with Canadian, U.S. and global equity markets all producing one-year returns to March 31 greater than 34%, in Canadian dollar terms. The shine of the astounding one-year performance numbers, however, comes off a bit when the preceding downturn period is taken into account. As you can see from the chart below, the total return numbers (which combines the one-year period with the preceding downturn period) for the Canadian, U.S. and global equity markets fall to 4.3%, 11.5% and 9.9%, respectively.

Posted In: Market Updates