Monthly Market Snapshot – March

Following strong gains in January, stocks closed lower in February. The market had priced in rate cuts in the second half of the year, but those expectations have largely vanished, with the market now assuming that the Federal Reserve will keep rates higher for longer. A hot jobs print and a slower decline in inflation contributed to the rise in rate expectations.

Canada’s benchmark S&P/TSX Composite Index was 2.6% lower in February, as eight of the benchmark’s underlying sectors were negative during the month. The decline was led by materials, energy and information technology, with losses of 8.8%, 4.8% and 4.7%, respectively. Small-cap stocks, as measured by the S&P/TSX SmallCap Index, fell 3.8% for the month.

The U.S. dollar appreciated by 2.6% versus the loonie during the month, providing a boost to returns of foreign markets from a Canadian investor’s standpoint. Note that all returns in this paragraph are in CAD terms. U.S.-based stocks, as measured by the S&P 500 Index, fell 0.5% in February. Energy, utilities and real estate had the steepest declines during the month, with respective losses of 5.6%, 4.3% and 4.0%. Information technology and industrials were the only sectors in the green during February, rising 2.5% and 1.0%, respectively. International stocks, as measured by the FTSE Developed ex US Index, fell 0.6% during the month, while emerging markets dropped 4.5%.

The investment grade fixed income indices we follow were down in February. Canadian investment grade bonds, as measured by the FTSE Canada Universe Bond Index, decreased by 2.0% during the month, while the key global investment grade bond benchmark fell 3.3%. Global highyield issues lost 1.5%. The losses came on the back of higher yields as investors increased bets on the Fed keeping rates higher for longer.

Turning to commodities, the price of natural gas rose 2.3% during the month, while crude oil shed 2.3%. Copper, silver, and gold were all in the red, with respective losses of 3.0%, 12.1% and 4.8%.

Inflation in Canada slowed to 5.9% year-over-year in January, with prices for cellular services and passenger vehicles contributing to the deceleration. The Canadian economy added 150,000 jobs in January, as the nation’s unemployment rate held steady at 5.0%. After the eighth consecutive rate hike last month, the Bank of Canada signaled it would be taking a conditional pause on any further hikes to let the impact of its aggressive hiking cycle sink in. The Canadian economy slowed, with real GDP remaining flat in the fourth quarter. Despite a lackluster end to 2022, the Canadian economy expanded by 3.4% for the entire year.

U.S. nonfarm payrolls increased by 517,000 in January, as the unemployment rate improved to 3.4%. The consumer price index increased 6.4% year-over-year in January. U.S. retail sales in January rose 3.0%. The Fed kicked off February with a 0.25% rate hike, pushing the policy rate to a range of 4.50% to 4.75%. The Fed indicated that policy intervention was starting to work on curbing inflation, but that rates may peak at a higher level.

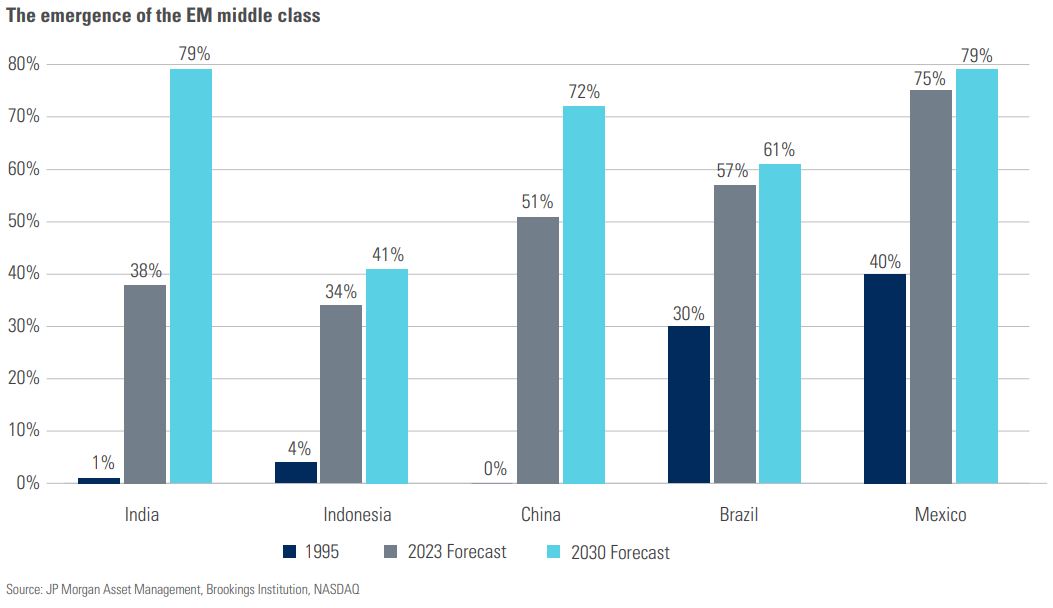

For emerging economies, a middle-class household is one where daily income is between US$11 and $110. As the chart above illustrates, a number of key emerging countries have seen significant increases in living standards since the mid-1990s. This trend is expected to continue over the next decade, particularly in India and China. These countries are expected to account for 66% of the world’s middle-class population by 2030. Moreover, it is anticipated that China and India will be responsible for 59% of global middle-class spending, which is estimated to total US$64 trillion by 2030. For context, global middle-class spending in 2015 was roughly US$35 trillion, and this was concentrated in the U.S. and Europe. The rapid development of the middle class in emerging countries might present a unique opportunity for investors and corporate players, but there are many risks that should be considered before investing in these regions, including political instability, restricted foreign accessibility, and immature corporate governance.

Posted In: Market Updates