Monthly Market Snapshot – September

Market volatility increased towards the end of the third quarter, as investor optimism seen in July and August was tempered by a variety of factors in September. Worries regarding the continuing spread of the Delta variant, renewed inflation-related concerns, the U.S. debt ceiling, regulatory crackdowns and a potential real estate default in China all pressured equity markets in September. Expectations for the U.S. Federal Reserve (the Fed) to begin tapering sooner rather than later aided in the rise of Treasury yields towards the end of the quarter, with growth and technology stocks being hardest hit by the rising rates.

Canada’s benchmark S&P/TSX Composite Index finished 2.5% lower in September, resulting in a 0.5% decline for the index in the third quarter. Half of the benchmark’s underlying sectors were positive during the quarter, led by consumer staples and industrials, with gains of 4.2% and 3.6%, respectively. The all-important financials and energy sectors ended the quarter up 0.3% and 1.6%, respectively. The health care, consumer discretionary and materials sectors were the main detractors for the quarter, with respective declines of 19.5%, 7.0% and 6.0%. Small-capitalization stocks, as measured by the S&P/TSX Small Cap Index, retreated 3.0% for the period.

The U.S. dollar was 2.3% higher versus the loonie during the quarter, providing a boost to returns of foreign markets from a Canadian investor’s standpoint (note that all returns in this paragraph are in Canadian-dollar terms). Despite declining 4.3% in September, U.S.-based stocks, as measured by the S&P 500 Index, finished the quarter up 2.5%. The benchmark’s top performing sectors for the quarter were financials, communication services and information technology, with respective gains of 4.6%, 3.7% and 3.4%. Industrials, materials and energy were the only sectors to decline during the quarter, falling 2.4%, 1.8% and 0.6%, respectively. International stocks, as measured by the MSCI EAFE Index, advanced 2.8% during the quarter, while emerging markets lost 6.8%.

The investment-grade fixed income indices we follow moved lower in the third quarter. Canadian investment-grade bonds, as measured by the FTSE Canada Universe Bond Index, shed 0.5% during the quarter, while the key global investmentgrade bond benchmark fell by 0.9%. Global high-yield issues added 0.4%.

Commodity prices were mixed during the third quarter. The price of a barrel of crude oil gained 2.1%, while natural gas soared 60.7%. Gold slipped 0.9% and silver decreased 15.7% over the period.Turning to economic news, inflation in Canada accelerated to 4.1% year-over-year in August. Canadian employment increased by 90,200 jobs in August, as the nation’s unemployment rate fell to 7.1%. The Bank of Canada left its key interest rate unchanged at 0.25% at its September meeting.

U.S. nonfarm payrolls increased by 235,000 in August, as the unemployment rate fell to 5.2%. The consumer price index increased 0.3% month-over-month in August, while the annual inflation figure climbed 5.3% from a year earlier. U.S. retail sales in August rose 0.7%. The Fed kept benchmark interest rates anchored near zero at its September meeting, with Fed Chair Jerome Powell indicating the U.S. central bank could begin scaling back asset purchases in November and complete the process by mid-2022.

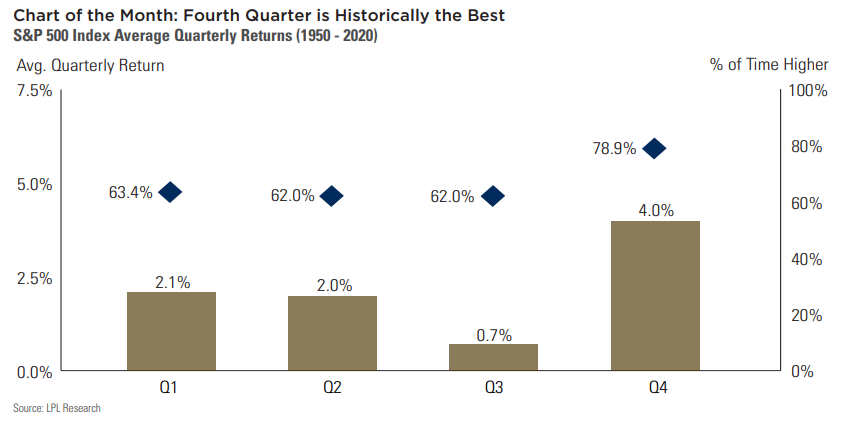

It was a tough way to close out Q3 with all major equity indices finishing in the red in September, bringing down third quarter returns. It was not unlike previous third quarters as Q3 is typically the worst quarter for stocks. According to LPL Research, the S&P 500 Index gained 0.7% on average in Q3 over the last 70 years, the lowest average return of any quarter. In contrast, U.S. stocks rose 4% on average during the fourth quarter, with Q4 being positive nearly 80% of the time. Of course, past performance is not an guarantee of future results, but data like this should induce optimism coming off of last month’s downturn as we move into the final three months of the year.

Posted In: Market Updates