Monthly Market Snapshot – September

Investors faced a challenging and volatile August as the stock market took a breather after what was a generally constructive first seven months of the year for equity investors. Canadian stocks fell, thanks in part to disappointing earnings from the financial sector and continued uncertainty in the economy. The S&P 500, as measured in USD, notched its first monthly decline since February. However, Nvidia’s stellar earnings report fueled more excitement in artificial intelligence, and Federal Reserve Chairman Jerome Powell’s speech at the Jackson Hole Economic Symposium boosted market sentiment in the closing weeks of August.

Canada’s benchmark S&P/TSX Composite Index was 1.6% lower in August, as seven of the underlying sectors in the index were negative during the month. Posting the biggest losses were consumer discretionary (-5.4%), utilities (-5.1%), financials (-4.4%) and materials (-4.0%). Energy was the top-performing sector, gaining 4.4%. Small-cap stocks, as measured by the S&P/TSX SmallCap Index, fell 1.5% for the month.

The U.S. dollar rose by 2.0% versus the loonie during the month, boosting returns of foreign markets from a Canadian investor’s standpoint. Note that all returns in this paragraph are in CAD terms. U.S.-based stocks, as measured by the S&P 500 Index, posted a 1.1% gain in August. Six of the underlying sectors were in the green for the month, with energy and telecommunication services leading the benchmark’s gain, rising 4.2% and 2.5%, respectively. International stocks, as measured by the FTSE Developed ex-US Index, declined 1.4% during the month, while emerging markets fell 3.0%.

The investment grade fixed income indices we follow were mixed in August. Canadian investment grade bonds, as measured by the FTSE Canada Universe Bond Index, decreased by 0.2% during the month, while the key global investment grade bond benchmark fell 1.4%. Global high-yield issues gained 0.3%.

Turning to commodities, natural gas prices rose 5.1% during the month, while the price of a barrel of crude oil rose 2.2%. Silver, gold and copper all had a negative month, declining 2.0%, 1.2% and 5.9%, respectively.

Inflation in Canada rose to 3.3% year-over-year in July, led by increases in energy and shelter costs. The Canadian economy lost 6,400 jobs in July, as the nation’s unemployment rate rose to 5.5%. The Bank of Canada’s decision to raise its key interest rate or hold steady at 5.00% will be announced on September 6.

U.S. nonfarm payrolls increased by 187,000 in July, as the unemployment rate improved to 3.5%. The consumer price index slowed to 3.2% year-over-year in July. The U.S. personal consumption expenditures price index increased 0.2% month-over-month. The federal funds rate was unchanged in August and remained at a target range of 5.25% to 5.50%.

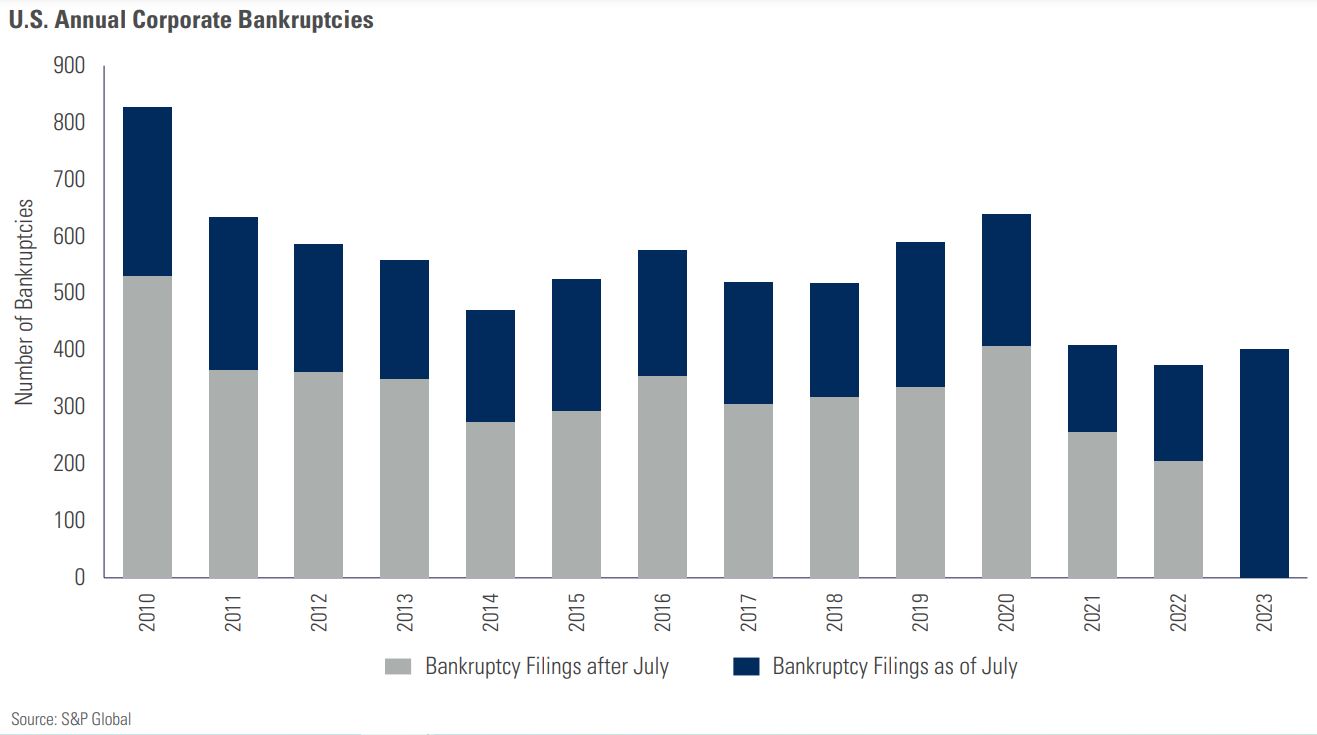

Chart of the Month: Corporate America Faces a Bankruptcy Boom

A significant spike in borrowing costs, combined with economic uncertainty, has created a difficult environment for corporations with larger debt loads. Corporate interest costs in the U.S. have risen 22% year on year since the first quarter of 2021 and Corporate bankruptcies are increasing at the fastest rate since 2010 (if not for the pandemic). They are nearly double what they were at this time last year. Companies that were struggling well before the pandemic and the end of near-zero interest rates have now reached their breaking point, and investors could expect additional filings later this year as tighter financial conditions are expected to persist.

Posted In: Market Updates