Staying the course in a bear market

Market volatility and major downturns may cause investors to rethink their investment approach, including moving to cash. Historically, a better approach has been to follow the lessons of the most successful investors: staying the course during a downturn – even adding to positions when the situation seems to be at its very worst – and then sitting tight for what history tells us will be the inevitable recovery.

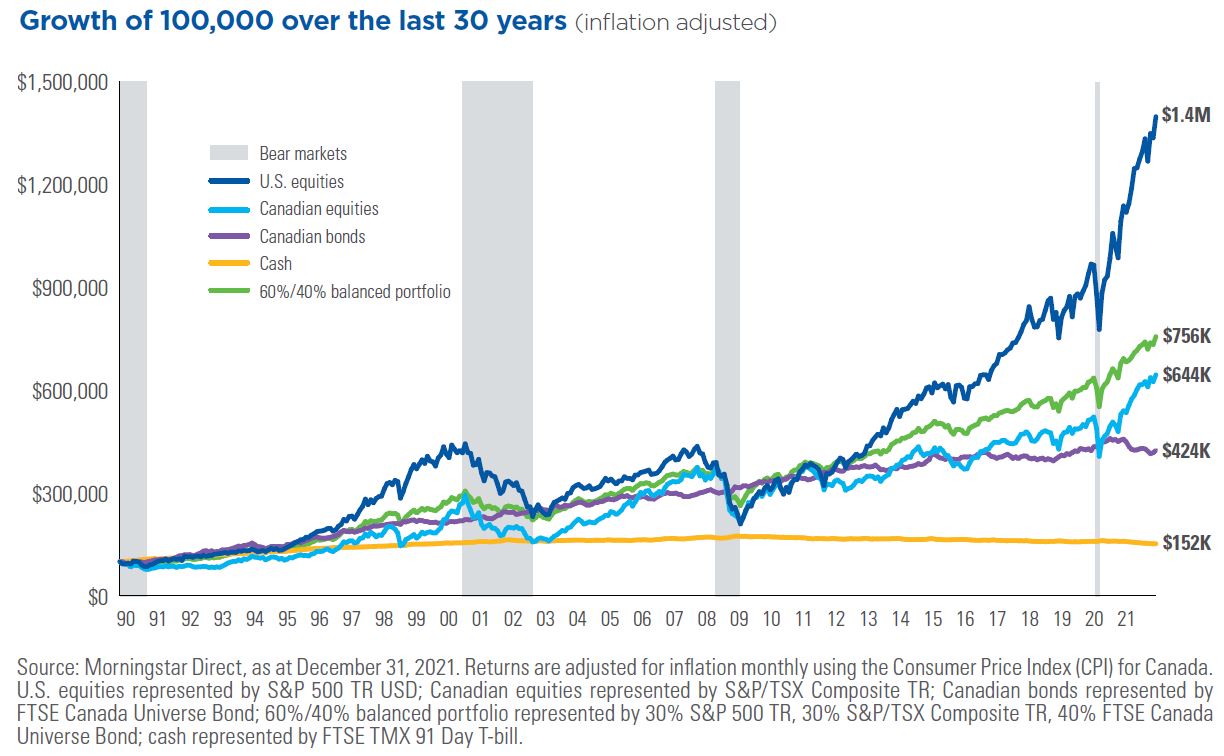

As the chart below shows, whether it’s stocks, bonds, or a mix of the two, time and time again bear markets have been followed by recoveries that exceed previous highs, while cash has only provided minimal opportunity for growth.

We understand that it can be hard to remove emotion from investing, especially when the media portrays "doom and gloom", focusing on daily swings. Rather, we'd like to shift your focus to the long-term goals of your portfolio and how that fits with your risk tolerance.

Investing takes patience and discipline. Our team is here to discuss any of your questions and concerns. Please don't hesitate to contact us.

Posted In: Market UpdatesInvesting Essentials